Reliance Industries Share Price Target From 2025 to 2030: The giant of India has always been on its way forward since the Indian nation has faced immense economic development through it. Diversification from energy and retail to communications has placed a solid ground, through which, undoubtedly, great heights are very near for Reliance Industries in the near future. This is the report presenting performance of the Reliance Industries Share Price from 2025-2030, while backing it up through data and market insights supported projections.

Summary Reliance Industries Share Price Performance

- Opening Price: ₹1,270.00

- High Price: ₹1,277.35

- Low Price: ₹1,261.60

- Market Cap.: ₹17.12 Lakh Crore

- P/E Ratio: 24.74

- Dividend Yield: 0.40%

- 52-Week High: ₹1,608.80

- 52-Week Low: ₹1,201.50

Market Depth For Reliance Industries Share Price

- Upper Circuit: ₹1,404.80

- Lower Circuit: ₹1,149.40

- Buy Order Quantity: 41.85%

- Sell Order Quantity: 58.15%

Bid and Ask Details For Reliance Industries Share Price

| Bid Price | Quantity | Ask Price | Quantity |

| ₹1,264.15 | 25 | ₹1,264.20 | 615 |

| ₹1,264.10 | 204 | ₹1,264.25 | 256 |

| ₹1,264.05 | 168 | ₹1,264.45 | 115 |

| ₹1,264.00 | 1,379 | ₹1,264.50 | 1,324 |

| ₹1,263.95 | 333 | ₹1,264.55 | 118 |

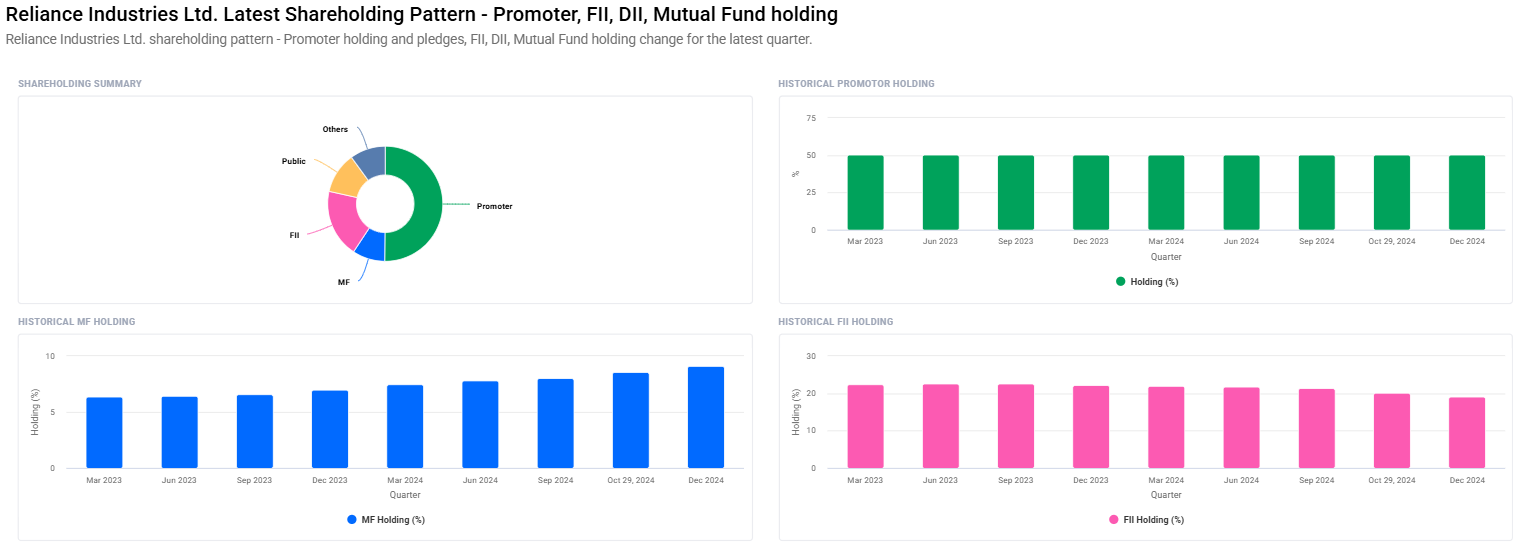

Institutional Holding Data For Reliance Industries Share Price

- Promoters: 50.13%

- Foreign Institutions (FII/FPI): 19.15%

- Declined from 21.30% in the preceding quarter.

- The number of investors declined to 2,232 from 2,376

- Mutual Funds: 9.14%

- Increased From 8.03%

- No. of Schemes: 86 declined from 87

- Other Domestic Institutions: 9.95%

- Retail and Others: 11.61%

Technical Analysis Data For Reliance Industries Share Price

| Indicator | Value | Implication |

| Day Momentum Score | 47.2 | Neutral |

| RSI (14) | 54.5 | Neutral |

| MFI | 63.0 | Neutral moving towards overbought 70+ |

| MACD (12, 26, 9) | 6.0 | Bullish Signal |

| MACD Signal | -1.1 | Bullish Signal |

| ATR (Day) | 25.3 | Volatility Index |

| ADX | 23.3 | Neutral |

| ROC (21) | 4.5 | Positive Momentum |

| ROC (125) | -14.6 | Negative Long-term Momentum |

Reliance Industries Share Price Target Forecasting:

| YEAR | Target Price in (₹) |

| 2025 | 1600 |

| 2026 | 2000 |

| 2027 | 2400 |

| 2028 | 2800 |

| 2029 | 3200 |

| 2030 | 3600 |

Company Information

Reliance Industries Limited is the largest Indian conglomerate working under diversified sectors that involve energy, petrochemicals, textiles, natural resources, retail, and telecom. It was founded by Dhirubhai Ambani in 1973. Its global contribution offers vast profit to the Indian economy

Major Facts

- Headquarters: Mumbai, Maharashtra.

- Chairman and Managing Director: Mukesh Ambani

- Key subsidiaries: Reliance Jio, Reliance Retail, and many more

- Vision: Sustained growth, innovation, and leadership in diversified sectors

Frequently Asked Questions For Reliance Industries Share Price

1. Is the investment in Reliance Industries a good one, even for 2025-2030?

It is stable and sound over time, whether telecommunication and retail, and such things. In comparison to the price target as per the projected rate, it looks like a pretty good long-term stock with market risk.

2. Growth drivers for Reliance Industries:

The major growth drivers would be expansion in Jio Platforms, retail ventures, and renewable energy initiatives. Put together with the focus on sustainability and technology, there is extra potential.

3. How does the dividend yield of Reliance compare to that of its industry?

Reliance’s dividend yield is 0.40%, so relatively modest compared to some peers, but indeed consistent with reinvestment-focused strategy.

4. Risks in the investment in Reliance

Risks are due to change in regulation, the global recession, and strong competitions exerting themselves in key areas like telecom and retail.

5. Technical Analysis for Investment Choices

MACD, RSI, MFI metrics are giving fair to positive trends in the stock. Investors would need to place this in context with the fundamental analysis and market conditions.