Reliance Power Share Price Target From 2025 to 2030: Reliance Power Limited is the group entity of the Reliance Group led by Anil Dhirubhai Ambani. Reliance Power is one of the largest and most trusted private sector power generation companies in the country. A strong firm, Reliance Power has a portfolio of varied projects in thermal, hydro, and renewable energy. Therefore, this company was also considered to be extremely relevant for the fast-expanding energy sector of India. Reliance Power Share Price Prediction 2025 to 2030: The study report on the latest market data, technical data, and industrial trends.

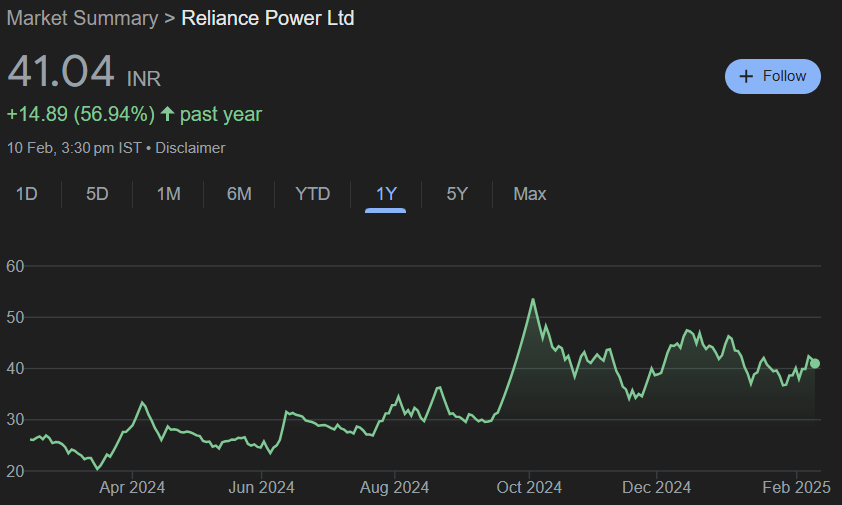

Current Market Snapshot (2025) For Reliance Power Share Price

- Opening Price: INR 42.40

- Highest Price: INR 42.59

- Lowest Price: INR 39.76

- Market Capitalization: INR 16,799 Cr

- P/E Ratio (TTM): 6.92

- EPS (TTM): INR 6.04

- Book Value: INR 35.83

- Debt to Equity Ratio: 1.04

- ROE: -13.61%

- Dividend Yield: 0%

- 52-Week High: INR 53.64

- 52-Week Low: INR 19.40

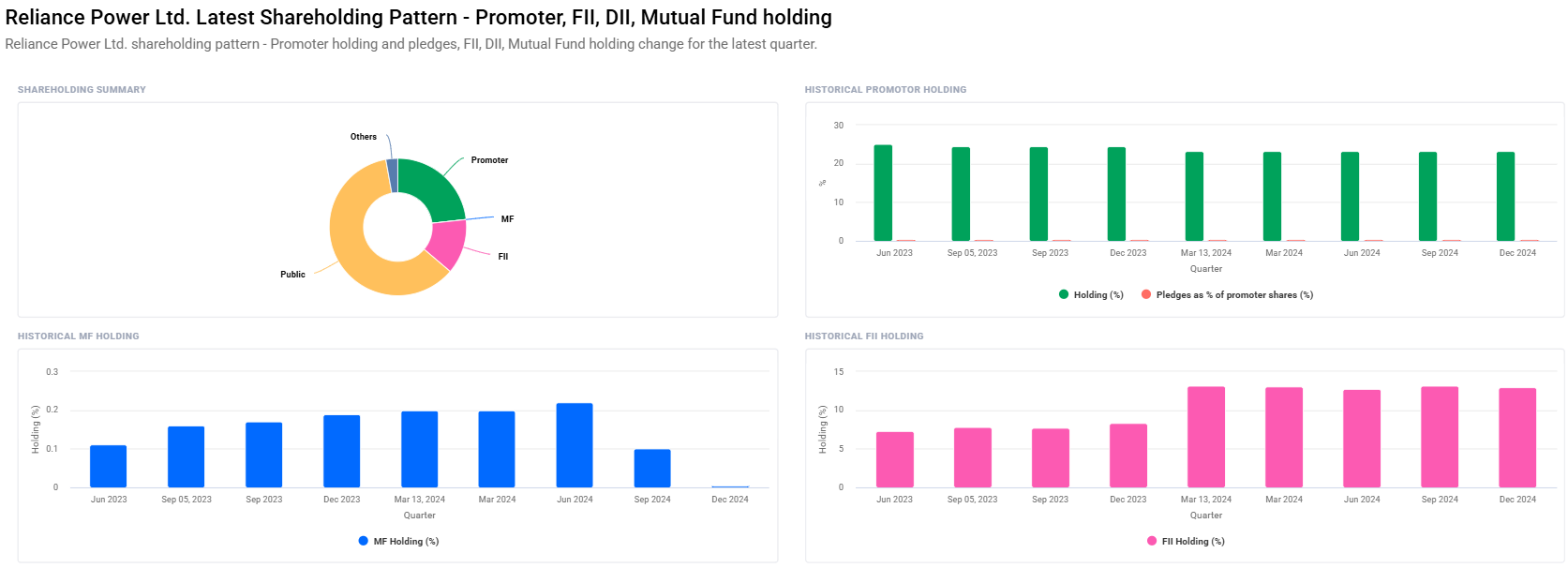

Ownership Structure For Reliance Power Share Price

- Promoters: 23.26% (No change)

- Retail and Others: 60.98%

- Foreign Institutions: 12.96% Declined from 13.12%

- Other Domestic Institutions: 2.80%

- Mutual Funds: 0.00% Earlier: 0.10%

FIIs increased FPI Investors count from 429 to 432 in this last quarter so foreigners are not losing interest yet the holding drops a wee.

Technical Summary of Analysis For Reliance Power Share Price

- Momentum Score: 57.6-Neutral on a Technical Front

- Day MACD : -0.1 is one for watch.

- Day ADX: 17.5

- Day RSI (14): 52.1 it lies in middle

- Day ROC (21): 10.7

- Day MFI: 56.3

- Day ATR: 2.13

Reliance Power Share Price Predictions (2025 to 2030)

Reliance Power Share Price Forecast for 2025: INR 60

Operational refinements by the company and sectoral improvement would enable Reliance Power to reach INR 60 by the end of 2025.

Reliance Power Share Price Forecast for 2026: INR 90

Renewable energy investment and debt management would enable the stock to reach INR 90. This is an important suggestion.

2027: Reliance Power Share Price Target INR 120

Improved profits along with a reduction in debt should make the stock price hit INR 120.

2028: Reliance Power Share Price Target INR 150

Operational efficiency along with project expansions is likely to push the stock up to INR 150.

2029: Reliance Power Share Price Target INR 180

With sustainable growth and favorable government policies, it should reach INR 180.

2030: Reliance Power Share Price Target INR 210

If Reliance Power can diversify and capitalize on trends in renewable energy, it would be able to reach a target share price of INR 210 by 2030.

Growth Influencers for Reliance Power Share Price

- Debt Pay-Down Attempts: Reliance Power’s current debt-to-equity ratio of 1.04 points towards the necessity to pay down on debt. By restructuring debt properly and improving management, profitability could be improved sharply.

- Renewable Energy Growth: The growth in green energy will be supportive. Investment in solar and wind energy projects will strengthen the company’s long-term prospects.

- Operational Efficiency: Improving operational efficiency in thermal plants will be very important to improve margins and competitiveness.

- Government Policies: Favorable regulations and incentives to renewable energy projects may offer tailwinds to Reliance Power.

- Increasing Global Demand for Energy: Growing energy use in India and other emerging nations will be supporting factors for the company’s Reliance Power.

Risks and Challenges For Reliance Power Share Price

- Substantial Debt Load: Reliance Power carries high levels of debt that create an underlying threat in terms of funding requirements. Very competitive power space with a new player entering in renewable energy.

- Regulatory Developments: Harmful policy amendments would be challenging to profitability.

- Operational Risks: Delays in project execution and technical issues in power plants can impact earnings.

Frequently Asked Questions (FAQs) For Reliance Power Share Price

Q1: What is the expected share price of Reliance Power in 2025?

A: At the close of 2025, share price of Reliance Power will be reached at Rs 60 as per prevailing trend and projected trends.

Q2: What is the threat of debt levels of Reliance Power?

A: The company’s debt equity ratio is at 1.04, that is the highly borrowed level affecting profitability and finance stability in one way or other.

Q3: How does the company see itself growing in the space of renewable energy?

A: Reliance Power is aggressively investing in solar and wind energy projects to take advantage of the rising tide of green energy.

Q4: Among the following are some major risks for Reliance Power investors.

A. High debt, Competition in markets, Changes in regulations, Operational issues.

Q5: What has been the promoter holding of the company recently?

A. It has remained at 23.26% .

Q6: The present P/E ratio of the company?

A. The current P/E ratio (TTM) is 6.92 which in comparison to industry peers is undervalued.

Q7. Does Reliance Power invest in renewable energy?

A. The company diversifies the portfolio of investing in projects relating to solar and wind energies.

Company Details

Reliance Power Limited had the first start up in 1995 and thus forms part of the group at Reliance. The company claims one of India’s largest privately-owned power-generating capacities. The company claims a rich diversity of portfolio across coal-based, gas-based, solar photovoltaic power and wind.

The company specializes in being one of the market leaders in the renewable energy segment and reducing carbon footprint through renewable energy solutions. Reliance Power has strategic focus areas on innovation and efficiency, making it one of the biggest players in the Indian energy market. Reliance Power has a lot of growth potential despite the problems it is facing currently. The stock will have long-term growth if it invests strategically in renewable energy, manages its debt well, and the market environment is favorable. High-risk investors with a long-term perspective will find Reliance Power an attractive opportunity.