Reliance Share Price Target From 2025 to 2030: As this company happens to be India’s biggest conglomerate, which deals with such a wide scope of petrochemicals, refining, telecom, retail, green energy, and several others, then with solid financials and with a good growth plan in place, this would become a pretty attractive investment area for most investors. This report estimates the future share price target of RIL from 2025 to 2030 based on the health of the financial statement, market condition, and prospect of growth in the near future.

Company Description

This company is a multination that originally is headquartered at Mumbai, India. It began as an innovation by Dhirubhai Ambani in the year 1973. RIL has occupied space in the global scene both on energy and telecom field outside of its own significant retail segment. The largest business divisions that belong to Reliance include:

- Energy and Petrochemicals: Globally leading Oil refining and Petrochemicals business firms.

- Retail: Among the largest organized retail chains in India.

- Telecom : Jio Platforms has revolutionized the Indian telecom space with super-fast data access to hundreds of millions of subscribers

- Green Energy: Really going all out big in green energy both in solar and hydrogen

Key Highlights

- Market Cap: ₹16.74 Lakh Crores

- P/E Ratio: 24.66

- Dividend Yield: 0.40%

- 52-week High: ₹1,608.80

- 52-week Low: ₹1,201.50

It maintains the overall group well-equipped for volatility and the diversified nature provides much upside within its offerings.

Latest Financial Chart For Reliance Share Price

- Open: ₹1,230.00

- High: ₹1,245.25

- Low: ₹1,226.40

- Price: ₹1,237.50

- Market Capitalisation: ₹16.74 Lakh Crores

- Dividend Yield: 0.40%

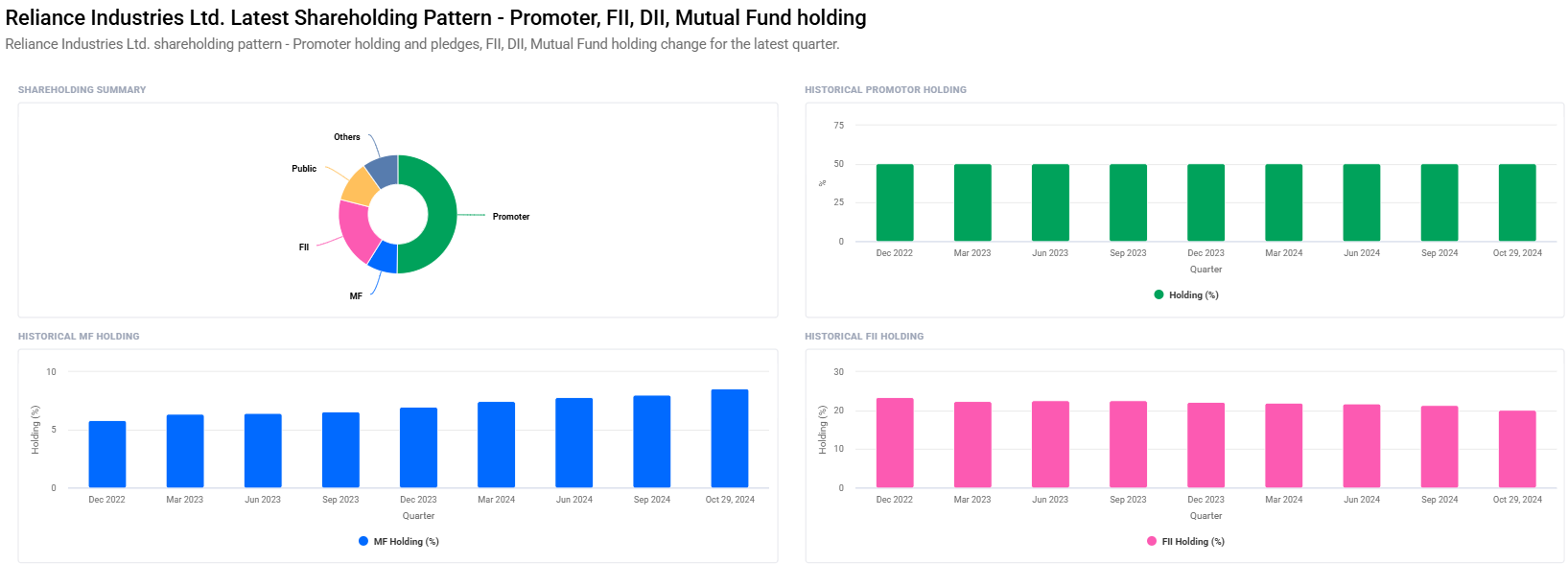

Shareholding Pattern For Reliance Share Price

- Promoters: 50.24% – a slight decrease from 50.33%

- Foreign Institutional Investors (FIIs): 20.17%

- Retail and Others: 11.28%

- Mutual Funds: 8.56% – up from 7.84%

- Other Domestic Institutions: 9.75%

Thus, the holding percentage of promoters is quite high; therefore, it is quite robust. Holding in mutual funds is on the increase, and hence it may seem that house is positive over its future outlook with Reliance.

Reliance Industries Share Price Target (2025-2030)

The revenues of Reliance Industries would surely provide sustainable returns to the shareholders on a proper base of sound basics and aggressive penetration in future-reap sectors like green energy and technology. Price target of shares in upcoming years are as under:

| YEAR | SHARE PRICE TARGET |

| 2025 | ₹1600 |

| 2026 | ₹2000 |

| 2027 | ₹2400 |

| 2028 | ₹2800 |

| 2029 | ₹3200 |

| 2030 | ₹3600 |

Reliance Share Price Growth Drivers

1. Green Energy Growth

Indeed, RIL’s core business lines have heavily invested in renewable energy, such as solar power, green hydrogen, and battery storage. RIL will be the world’s biggest green energy player by virtue of its solar panel Giga factories, battery factories, and electrolyzer plants.

2. Growth in retail and e-commerce

Reliance Retail is expanding footprints in India through physical stores as well as through online platforms. The scope of JioMart and the alliance with international retailing giants will lead to an exponential growth curve for the retailing business.

3. Leadership in Telecommunications

Reliance Jio has transformed the Indian telecom landscape by holding an extremely critical position in this space. 5G roll out and digital services will further cement its status as an important contributor to Jio Platforms’ revenue streams.

4. Strong Refining and Petrochemical Business

The world is gradually but surely shifting to renewable sources of energy. However, refining and petrochemical businesses have been cash cows for RIL. Strategic plays into high-value petrochemical products would ensure steady cash flows.

5. Global Expansion

The Saudi Aramco, Google, and Facebook deals would make Reliance house-hold names and unlock enormous revenues

6. Digital Transformation

It will be aligned with the worldwide trend of accepting the digital transformation process, like High Technology investment in IT and utilization of a digital platform. The growth of Reliance will be on artificial intelligence and cloud computing and several other innovations related to e-commerce.

7. Debt reduction-the thrust area

This, besides partner’s balance-sheet strengthening through investment, also has debt reduction and strategic equity in the firm improving growth prospects for industries.

2025: Reliance Share Price Target ₹1,600

By 2025, the share of Reliance will be ₹1,600. It would get achieved through an incremental add to this offer, namely, Jio’s 5G followed by the entry of Reliance Retail into Tier 2 and Tier 3 cities.

2026: Reliance Share Price Target ₹2,000

That would be when the stock price hits ₹2,000 by 2026. The plays from Reliance through solar as well as hydrogen will be a very significant revenue generator.

2027: Reliance Share Price Target ₹2,400

The share price of Reliance will hit ₹2,400 by 2027. Growth is driven in the form of increasing digital services and retail business for Jio along with the step-up refining business margins.

2028: Reliance Share Price Target ₹2,800

It is going to be a retail business in the Indian market, and green energy solutions are going to be more in demand. Stock will touch ₹2,800 by 2028.

2029: Reliance Share Price Target ₹3,200

Share price to reach ₹3,200 by 2029. Good revenue growth since Reliance Industries would be at leading positions in so many sectors of the business and economies of scale.

2030: Reliance Share Price Target ₹3,600

Reliance Industries is going to achieve the share price of ₹3,600 by 2030. It is going to complete its green energy projects. Reliance shall maintain leadership positions in telecom, retail, and petrochemical sectors.

FAQ For Reliance Share Price

1. Is Reliance Industries a good long-term investment?

Reliance Industries is a good long-term investment, diversified business models, in most business sectors it is on the leading edge, and focuses on future-ready areas like the green energy segment and areas of digital transformation.

2. What are the risks involved in investing in Reliance Industries?

The principal risks include crude oil price volatility, competition in telecom and retail, and execution risk on green energy projects.

3. How would Reliance reduce its carbon footprint?

Reliance is going to have a net-zero carbon footprint by 2035. It is investing in heavy green energy projects that include solar power, green hydrogen, and battery storage.

4. What is the dividend yield of Reliance Industries?

The dividend yield of Reliance Industries is 0.40%, and that indicates it is quite keen to reinvest in profit so that growth could be achieved.

5. How mutual fund has changed the interest of Reliance?

The holding of Reliance through mutual funds increased from 7.84% to 8.03%. Mutual fund confidence has improved marginally at the cost of institutional investors’ confidence.

6. Why Reliance Retail is a growth driver?

It has an enormous shop-in-shop presence, and it also supports its ecommerce facility JioMart, which has captured a prominent place in the expansive growth curve of India’s organized retail space.

7. How is Jio Platforms contributing to the growth of Reliance?

Jio Platforms still remains the growth driver for the group, and contributions go to group revenues through telecom services, digital platforms, and partnership with leading global technology leaders.

8. How does Reliance intend to green its energy portfolio?

Reliance is building giga factories for solar panels, batteries, and hydrogen electrolyzers in order to lead the global renewable energy ecosystem.

Reliance Industries is a symbol and flagship of India’s industrial and economic transformation. A diversified business model with strategic investments in future-ready sectors along with an excellent financial base will enable sustainable growth. Reliance Share Price targets for 2025-2030 testify to huge returns for long-term investors as it has been more of a tale and an impressive investment opportunity across the growth trajectories of India under the leadership extended into the industry by Reliance itself.