SAIL Share Price Target From 2025 to 2030: Steel Authority of India Ltd. (SAIL) is one of the most important metal-producing groups in India and a good sized participant within the global steel industry. The agency operates in more than one segments, which include manufacturing and selling metallic merchandise, presenting engineering and consultancy services, and running iron ore and coal mines. SAIL has a strong presence in each home and international markets and maintains to make bigger its production ability to satisfy developing demand.

Current Market Overview For SAIL Share Price

- Stock Price: 105.50 INR

- 52-Week High: 175.35 INR

- 52-Week Low: 99.15 INR

- Market Cap: 43.70 K Cr

- P/E Ratio: 17.26

- Dividend Yield: 1.90%

- ROE: 5.48%

- EPS (TTM): 6.12

- Debt to Equity: 0.72

- Book Value: 139.42

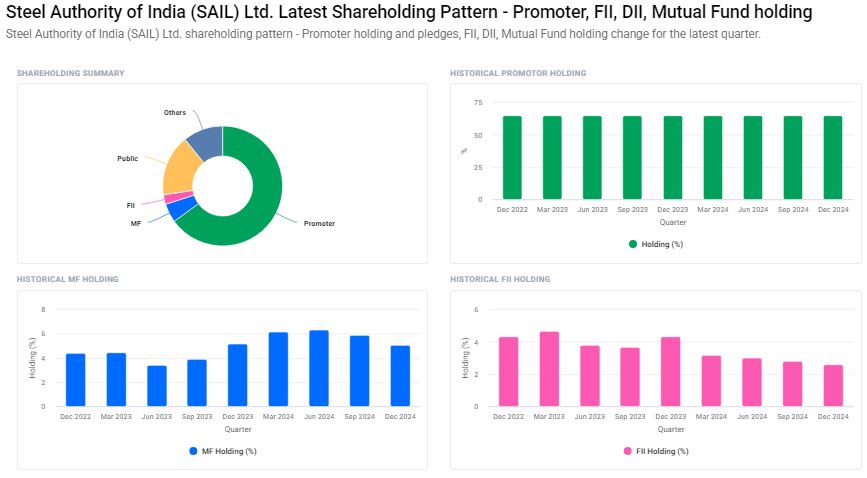

Institutional Holdings For SAIL Share Price

- Promoters Holding: 65.00%

- Retail and Others: 16.55%

- Other Domestic Institutions: 10.78%

- Mutual Funds: 5.08%

- Foreign Institutions: 2.59%

Technical Indicators For SAIL Share Price

- Momentum Score: 36.8 (Neutral)

- RSI (14-day): 47.4 (Neutral)

- MFI: 58.6 (Neutral)

- MACD (12, 26, 9): -1.6 (Bearish)

- ATR: 4.2

- ADX: 27.7 (Neutral)

- ROC (21): 0.5 (Neutral)

- ROC (125): -17.6 (Bearish)

SAIL Share Price Target For 2025 to 2030

| YEAR | TARGET PRICE (INR) |

| 2025 | INR 200 |

| 2026 | INR 275 |

| 2027 | INR 350 |

| 2028 | INR 425 |

| 2029 | INR 500 |

| 2030 | INR 575 |

Year

Expected Price (INR)

2025

2 hundred

2026

275

2027

350

2028

425

2029

500

2030

575

Factors Influencing SAIL Share Price Growth

1. Increasing Steel Demand

The developing infrastructure and construction sectors in India, together with growing global call for for metallic, will play a key function in boosting SAIL’s revenue and stock price.

2. Government Policies

Policies helping home manufacturing and infrastructure improvement will choose metal businesses like SAIL, increasing production potential and sales.

3. Technological Advancements

Adopting modern-day metallic production technology will enhance performance, lessen prices, and beautify profitability, thereby riding stock charges higher.

4. Debt Reduction

A lower debt-to-fairness ratio will strengthen SAIL’s financial fitness, attracting more investors and positively impacting proportion fees.

5. Global Steel Prices

The fluctuations in international steel costs affect profitability. An boom in worldwide metallic costs can result in higher revenues and inventory appreciation for SAIL.

6. Expansion Plans

SAIL’s enlargement plans, together with putting in new vegetation and growing manufacturing capability, will decorate its marketplace position and make contributions to long-time period boom.

7. Foreign Investments

An growth in FII and FPI investments will carry liquidity and raise investor self belief, positively impacting the inventory fee.

Risks and Challenges For SAIL Share Price

- Fluctuations in Raw Material Prices: Prices of iron ore and coal extensively effect the value structure and profitability of SAIL.

- Global Economic Slowdown: A slowdown inside the global financial system can lessen demand for steel, affecting sales boom.

- Regulatory Changes: Stringent environmental guidelines and government rules could impact SAIL’s operations and profitability.

- Competition: Rising competition from non-public metallic manufacturers should affect marketplace proportion and revenue growth.

FAQs For SAIL Share Price

1. Is SAIL an awesome investment for the long time?

Yes, SAIL has sturdy fundamentals, and its destiny boom potentialities are promising due to growing metallic call for and government help for infrastructure projects.

2. What is the expected share price of SAIL in 2025?

Based on market analysis and increase projections, SAIL’s inventory rate is expected to reach around two hundred INR by way of 2025.

3. Will SAIL’s inventory price attain 500 INR by way of 2029?

Given the enterprise’s expansion plans, rising call for for metallic, and authorities assist, it’s miles feasible for SAIL’s inventory rate to reach 500 INR via 2029.

4. What are the key dangers for investing in SAIL?

Key risks consist of fluctuations in uncooked fabric charges, international economic situations, regulatory adjustments, and extended opposition.

5. Does SAIL pay dividends?

Yes, SAIL has a history of paying dividends, and its modern dividend yield is around 1.90%.

6. What is the lengthy-term outlook for SAIL?

The lengthy-term outlook for SAIL is tremendous, with expected increase inside the steel enterprise, strong authorities policies, and infrastructure initiatives helping demand.

7. How does the worldwide metallic market effect SAIL?

Global metallic prices, deliver and call for, and geopolitical elements affect SAIL’s profitability and stock charge actions.

Steel Authority of India Ltd. (SAIL) is a main metallic manufacturer with a robust marketplace function and increase capacity. With growing infrastructure demand, technological advancements, and favorable government guidelines, SAIL’s inventory is predicted to grow steadily from 2025 to 2030. However, investors should consider marketplace dangers and conduct thorough research earlier than making funding decisions.