Shreeram Proteins Share Price Target From 2025 to 2030: Shreeram Proteins Ltd is not too great a player in the Indian protein and animal feed industry. Lower stock value coupled with the colossal opportunities for the development of the agro-based industry in India made this company spotlight-worthy. Shreeram Proteins’s market capitalisation is ₹51.41 Crore, while the fluctuation in its stocks gives a prospect of opportunity mixed with risk from an investor’s perspective. Let’s get into the stock fundamentals and technical analysis and set a realistic Shreeram Proteins Share Price for the years 2025 to 2030.

Shreeram Proteins Ltd: Company Snapshot

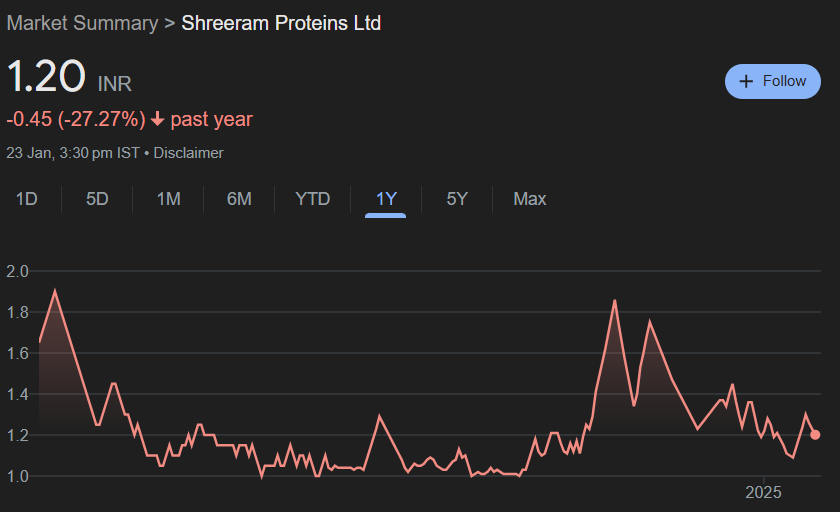

- Market Capitalization: ₹51.41 Crore

- Opening Price: ₹1.20

- Previous Close: ₹1.23

- 52-Week High: ₹1.95

- 52-Week Low: ₹0.99

- Volume: 87,834

- Total Traded Value: ₹0.01 Crore

- Upper Circuit: ₹1.25

- Lower Circuit: ₹1.20

Shreeram Proteins Ltd. is a leading manufacturer and marketer of animal feed in India, thereby holding a strategic position in the livestock and poultry industries. Being a competitive market, growth is bound to high-quality animal protein products. Growing populations and increased disposable incomes are further increasing the demand for poultry, dairy, and other protein-based products, hence, creating an ever-larger market for a company like Shreeram Proteins.

Key Financials For Shreeram Proteins Share Price

- P/E Ratio: N/A (The company has not broken even to get a P/E ratio)

- P/B Ratio: -2.62 (Negative P/B ratio reflects that the stock of the company is trading at lower book value, and this could be an indication of stress on the company’s financial condition).

- Debt-to-Equity Ratio: 1.10 (Debt is higher than equity, and it may pose a danger if not properly controlled).

- ROE (Return on Equity): -58.14% Negative ROE is a bad sign which indicates that the company is not generating any return from shareholders’ equity.

- EPS (Earnings Per Share): -0.47 Negative EPS indicates that the company is not making any profit currently.

- Dividend Yield: 0.00% Dividend is not being given at this point of time.

- Book Value: ₹1.30 Market price is nearly close to the book value.

The financials show some stress in Shreeram Proteins; the negatives are return on equity and, of course a very high ratio of debt to equity; this would also mean that any turn in profitability would see a sharp upside.

Shreeram Proteins Share Price Movement and Technical Analysis

- 52 Week High: ₹1.95

- 52 Week Low: ₹0.99

- Current Open: ₹1.20

- Prev. Close: ₹1.23

- Circuit Limits: Upper Circuit at ₹1.25 and Lower Circuit at ₹1.20

Shreeram Proteins trades in a very narrow range of a year at ₹0.99 to ₹1.95 with high volatility of the stock prices. The stock hits circuit limits quite often. This reflects that it is under keen observation and volatilizing due to sentiment of the market.

Ownership Structure and Market Sentiment For Shreeram Proteins Share Price

- Retail and Others: 91.44%

- Foreign Institutional Investors (FII): 4.48%

- Promoters: 4.08%

Major portions of shares are held by retail investors, which essentially means high volatilities and no institutional support. However, the small portions of shares being held by foreign institutions do suggest that at least some investors do see some promise in Shreeram Proteins.

Shreeram Proteins Share Price: Industry Outlook and Growth Potential

Indian economy is definitely growing as a share in animal feed production, but Shreeram Proteins operates on an operational platform that goes in conjunction with the business of feed production with its parent industries, including poultry, dairy, and livestock, which have increasing domestic as well as international demands. Companies like Shreeram Proteins become relevant with such expansion of this industry because growing awareness about good-quality feed goes hand in hand with health and productivity.

Another fact that makes Indian companies benefitting significantly is because it is a vast consumer of animal-based protein products worldwide; animal feed will obviously witness increased demands and thus present gigantic growth opportunity to Shreeram Proteins. In reality, Shreeram has to encounter some financial obstacles in its management before it takes this advantage for granted.

Risk Threatening Shreeram Proteins Share Price

- Debt Burden: The debt to equity is quite high for the company at present which is 1.10. In other words, it carries a huge amount of debt upon itself. In case such heavy borrowings are not handled properly then serious liquidity problems can be seen from the side of the company that would affect its growth and its ability to give returns for investors.

- Non-Earnings: Since the ROE is negative and so is the EPS, Shreeram Proteins can be termed to be non-earning currently. It will be a risk-investment for anyone considering investing in the company. The investor will wish to tread with care so as to observe whether the operations can improve enough so that it begins to earn profit.

- Market Volatility: The stock is highly volatile with frequent price swings and circuit limit hits, which means it’s speculative in nature. Therefore, it is more suitable for traders rather than for a long-term investor.

Shreeram Proteins Share Price Target Projection (2025-2030)

With the current financial issues in the company, many factors are to be kept in mind to predict the future stock price of the company such as:

- Debt Management: If Shreeram Proteins is able to bring down its debt and improve profitability, the stock price can move pretty sharply upwards.

- Market Conditions: Presently, company performance is correlated with the overall animal feed and agriculture industry, which might benefit in case demand for protein product continues their upward progression in India.

- Strategic Alliance or Expansion: Large partnership or expansion capacity deals can assist the company in tapping market demand

2025: Shreeram Proteins Share Price Target ₹2.00

Given the existing financial distress in Shreeram Proteins and volatility of its stock, a price target of ₹2.00 as on 2025 looks achievable. It would only partially reverse the prevailing price band, since the company will begin to report turnaround of financial performance or at least stabilize the operations.

2026: Shreeram Proteins Share Price Target ₹3.00

By 2026, if Shreeram Proteins can resolve its debt issue and maintain earnings, its stock can reach ₹3.00. To achieve this, the overall performance of the industry needs to be more favorable to the company overcoming its operational problems. This path of stable growth can result in this stock price.

2027 Shreeram Proteins Share Price Target: ₹4.00

At this stage, if Shreeram Proteins is able to strengthen its profitability and market position then the stock could reach ₹4.00 by 2027. Assuming that the company has brought down its debt and taken huge strides to get its financials in order.

2028: Shreeram Proteins Share Price Target ₹5.00

Based on the sustained trend of profit improvement that it would derive and the leverage it would garner from a rise in the demand for animal feed in India, the company will be able to achieve a price target of ₹5.00 by 2028.

This would depict growth for the company both in revenues as well as market share of animal feeds.

2029 Shreeram Proteins Share Price Target: ₹6.00

At Shreeram Proteins level 2029 it shall be considerably much sound entity. Result of its operations will go significantly well based upon industry and, financial gain to the organisation on top with chances of eroded debt portion to the zero position. Strong Growth and confident marketplace about good Future ₹ 6.00.

2030: Shreeram Proteins Share Price Target: ₹ 7.00

Assuming Shreeram Proteins can overcome its challenges and becomes profitable with healthy market share gains in the huge and growing animal feed market, a target of ₹7.00 by 2030 is achievable. The company would be very recovered and well-grown then and on better fundamentals as well as improving market conditions, the company might start commanding a higher multiple.

Frequently Asked Questions (FAQs) For Shreeram Proteins Share Price

1. Why is the stock of Shreeram Proteins so volatile?

The stock is volatile because its low market capitalization, speculative, and has retail investor participation highly. Poor financials with the high debt level bring the frequency of price variations of the stock.

2. Is Shreeram Proteins a good stock to invest?

Shreeram Proteins is perhaps one of the riskiest investments because of its financial problems. Even if the industry is booming in which it operates, the company must sort out the debt problem and improve profitability so that it will be a good investment option.

3. Future prospects of Shreeram Proteins

The future upside for Shreeram Proteins is going to be heavily a function of paying down debt, increasing profitability and capturing market share in this ever-growing animal feed sector. The potential upside is very significant if they can navigate the present difficulties.

4. Why isn’t the P/E ratio showing up for Shreeram Proteins?

Shreeram Proteins is yet to be in the profitable margin hence, the P/E ratio can’t be disclosed since there exists a negative earning figure. Generally, the P/E ratio could be applied by a profitable firm.

5. Long term target price for Shreeram Proteins

Long term Shreeram Proteins Share Price target would be ₹7.00 until 2030 as the improvement in the firm’s financial will take place by gaining benefits by the increasing demands of animal feeds in India.

Shreeram Proteins Ltd. is a very high-risk, very high-reward kind of investment. Company is facing very bad conditions of finance; it is having negative ROE, huge burden of debt, and it is not generating any profit, but it is in a growth industry with huge scope. If the company can improve its financial health and capitalize on the demand for quality animal feed, then the stock can grow significantly in the next five to ten years. Nevertheless, the future investors should be wary and monitor closely the turnaround of the company’s financial situation before they invest.