Sun Pharma Share Price Target From 2025 to 2030: Sun Pharmaceutical Industries Ltd very well could be the first of its class, with India being the home country; it also sets out the domination by these two houses in the related space of other domestic and international markets performing pharmaceutical formulation and APIs products. This is one such reason in some such instances Sun Pharma has grabbed its position within promising stocks in which investors should consider putting inside their watchlist if they must buy a pharmaceutical stock.

Company Profile

- Market Value: ₹4.19 lakh crore

- EPS: 36.59

- Dividend yield: 0.89%

- 52 week highs: ₹ 1,960.35.

- 52 week Low: ₹1,377.20

- Debt to Equity: 0.04

- Return on capital: 15.99%.

- Earning/Share: (TTM- ₹47.65).

- Books value: ₹288.08

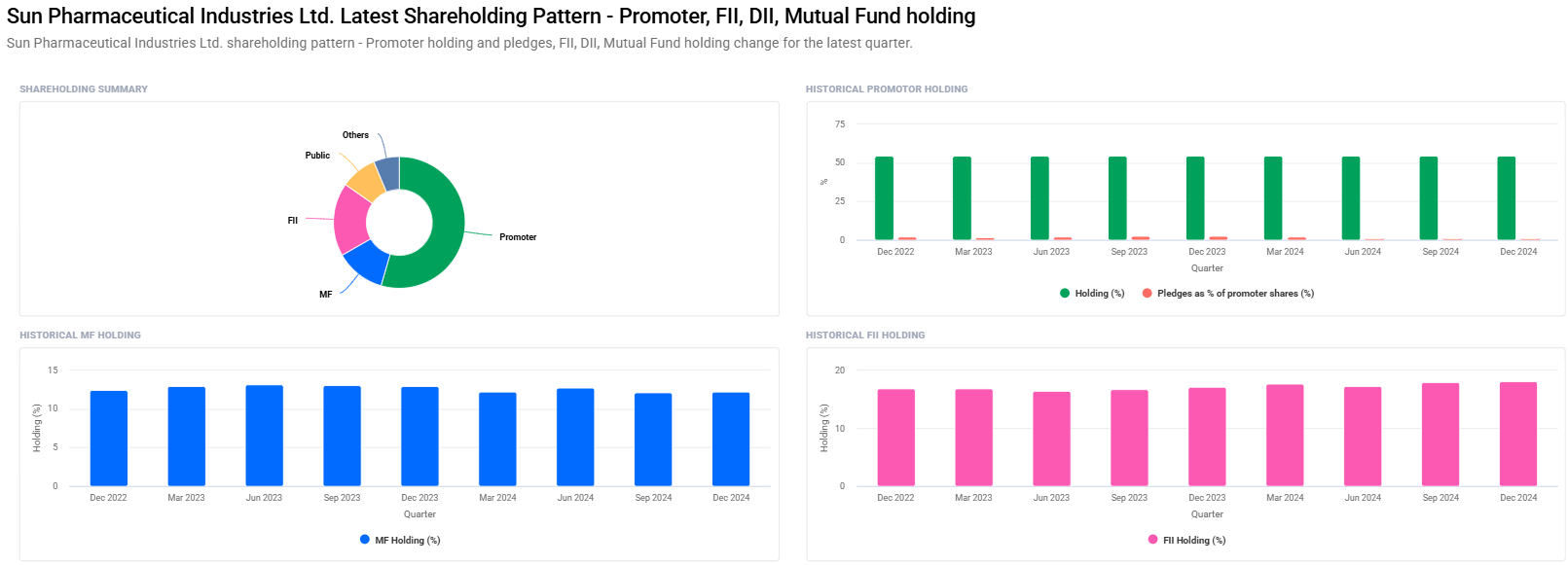

Shareholding Pattern For Sun Pharma Share Price

- The promoters holding as of 54.48 %.Unpledged :0.69%.

- FIIs holding are 18.04%.

- FII holdings and Mutual Fund as of 12.24%.

The finance of Sun Pharma is excellent constantly, low in debt, promising trend in drugs development and innovation, thus, making it as a good long-term bet stock.

Technical Analysis For Sun Pharma Share Price

- Day Momentum Score: 52.4 Neutral

- Day MACD(12,26,9): -17.0 Bearish sign

- Day ADX: 28.7 Neutral trend, no bullish or bearish pattern

- Day RSI (14): 44.7 Neutral Area

- Day MFI: 35.5 Reaching The Oversold Condition

- Day ATR: 43.0

From the technical perspective, the trend is short term range-bound but has a minor bearish side. Long term, however, growth for the company will remain healthy due to a strong base of funds.

Sun Pharma Share Price Targets 2025 to 2030

| YEAR | TARGET PRICE (₹) |

| 2025 | ₹2000 |

| 2026 | ₹2600 |

| 2027 | ₹3200 |

| 2028 | ₹3800 |

| 2029 | ₹4400 |

| 2030 | ₹5000 |

2025: Sun Pharma Share Price Target ₹2,000

Sun Pharma is to be a growth year in the year 2025. Better specialty drug development and increased export will help in reaching the target price of ₹2,000 per share at the end of 2025.

2026: Sun Pharma Share Price Target ₹2,600

By 2026, strategic R&D, and related tie-up with global pharmaceutical companies are going to create growth. At this point in time, it would be good enough to consider a price target of ₹2,600 at the end of the year 2026

2027: Sun Pharma Share Price Target ₹3,200

Have an expansion foot in emerging markets too, Sun Pharma. Thus, the share price is likely to go higher up. Forecast target for the year 2027 would be around ₹3,200.

2028: Sun Pharma Share Price Target ₹3,800

Sun Pharma is going to prove a breakout year in 2028. This is due to new drug launches and penetration into new markets. Share price would likely reach ₹3,800.

2029: Sun Pharma Share Price Target ₹4,400

Biosimilars and specialty drug market would continue success for Sun Pharma in 2029. Target in this year stands at ₹4,400.

2030: Sun Pharma Share Price Target ₹5,000

Sun Pharma can further solidify its global pharmaceutical leadership profile by 2030. The share price target for 2030 is around ₹5,000. This is growth beyond the decade.

Determinants of Growth of Sun Pharma Share Price

- R&D Expenditure: Sun Pharma has been consistently spending on research and development, especially in the specialty drugs segment to facilitate the growth of the company.

- Going international: The company will have a strong focus on the US, Europe, and other emerging markets that would propel the revenue growth.

- Enhanced pipeline of drugs: Launches and approvals of new drugs would enhance the competitiveness of Sun Pharma along the pharmaceutical industry chain.

- Regulatory environment will improve: Positive regulatory changes and approvals will come in favor of the company performance.

- Strategic acquisitions and alliances: Acquisitions, mergers, and alliances will strengthen market position and operation capabilities of Sun Pharma.

Macro factors, exchange rate, geopolitical dynamics will be the other driving factors for share price trajectory also.

Question: Frequently Asked Questions About Sun Pharma Share Price Target

1. Sun Pharma is good stock for a long-term investment?

Sun Pharma has a strong pipeline, minimal debt, and steady financial performance. This makes it a safe bet for long-term investors.

2. What are some of the negative deterrents to the Sun Pharma share price?

Some of the negative deterrents to the share price include adverse regulatory changes, delay in the drug approvals and litigation risks, along with global economic instability.

3. Why is the P/E ratio of Sun Pharma high compared to peers in the same industry?

It reflects investor optimism about the growth perspective of Sun Pharma based on its robust pipeline, innovation, and global market presence.

4. What is the company policy on paying out its dividends?

Sun Pharma has a relatively low dividend yield of 0.77%, indicating an intent to plow back into the company for expansion purposes.

5. How does Sun Pharma compare to peers and competition?

It differs in many ways: international presence, diversified product offerings, specialty drugs focus are some areas where the company is an edge from most of the domestic and international peers.

6. Any specific reasons for the company having a low debt-to-equity ratio?

A debt-to-equity ratio of 0.04 shows that Sun Pharma has a low debt liability, which puts the company in an era of financial stability and risk-free for investors.

7. Role of institutional investors in the expansion of Sun Pharma:

The share capital is owned by institutional investors like FIIs and mutual funds in the company Sun Pharma. This reveals that the market believes that the future of the corporation is healthy and sound.

8. How is the promoter holding of Sun Pharma being managed?

The unpledged promoter’s holding at the company depicts that the group has improved regarding the financial stability it owns and an upbeat feel in the market.

Sun Pharma has been one of the top long-term investment bets within the pharmaceutical industry. With new approaches in the development of drugs, exposure globally, and a solid financial position, the company will bring significant returns to the investors. Share price targets from 2025 to 2030 clearly indicate that this stock is growing and ready to take the market by storm. In all probability, it is going to remain an investment ground as long as the trend of this particular stock continues to go like the Sun Pharma’s.