Suzlon Energy Share Price Target From 2025 to 2030: Suzlon Energy Limited is one of the prominent companies in the renewable power industry, with fame for wind turbines and clean energy solutions. Increased steady global attention towards sustainability and acceptance of renewable energy has positioned Suzlon as one of the most significant contributors to the green energy revolution in India. Let’s de-garble the company’s financial health, technical trends, and growth potential while getting into Suzlon Energy Share Price Target From 2025 to 2030.

Key Performance Indicators For Suzlon Energy Share Price

| Metric | Value |

| Open | ₹58.35 |

| High | ₹58.47 |

| Low | ₹56.35 |

| Market Cap | ₹78,692 Cr |

| P/E Ratio (TTM) | 81.87 |

| P/B Ratio | 17.60 |

| Debt-to-Equity Ratio | 0.06 |

| ROE | 21.35% |

| 52-Week High | ₹86.04 |

| 52-Week Low | ₹35.50 |

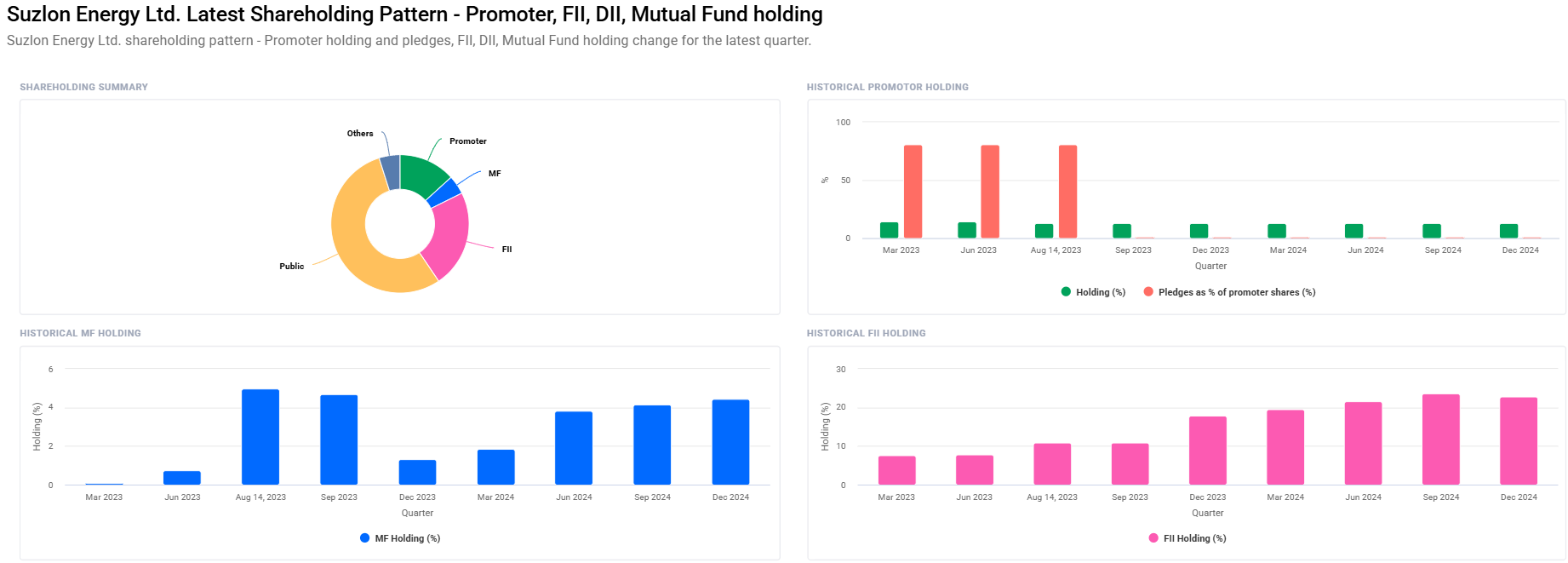

Institutional Holdings and Trends For Suzlon Energy Share Price

| Category | Percentage |

| Promoters | 13.25% (No Change) |

| Retail & Others | 54.56% |

| Foreign Institutions (FII/FPI) | 22.88% (From 23.72%) |

| Mutual Funds | 4.44% (From 4.14%) |

| Other Domestic Institutions | 4.87% |

Shareholding Pattern Change For Suzlon Energy Share Price

- Promoter Holding did not change; that gives a good sign of the confidence in the company’s prospects.

- FIIs declined slightly but investor count increased, thus hinting at increased global interest.

- Mutual Fund Investment went up as institutions became positive on Suzlon.

Suzlon Energy Share Price Target (2025-2030)

| Year | Target Price (₹) | Growth Catalyst |

| 2025 | ₹90 | Wind power project expansion, debt reduction |

| 2026 | ₹140 | Renewable demand revival, new government policies |

| 2027 | ₹190 | Margin expansion, global partnership |

| 2028 | ₹240 | Foray into solar and Hybrid energy |

| 2029 | ₹300 | Green Hydrogen, International foray |

| 2030 | ₹360 | Market leader in RE. ROE better |

Technical Analysis: Recent Trends and Indicators For Suzlon Energy Share Price

Momentum Indicators

| Indicator | Value | Interpretation |

| RSII (14) | 41.0 | |

| MACD (12,26,9) | -2.1 | Bearish; below signal and the center line |

| MFI (Money Flow) | 29.2 | Oversold; it may recover soon |

| ADX (Trend Strength) | 21.4 | Weak trend; strong trend can develop with positive news |

Volatility Indicators

- ATR (Average True Range): 2.5

- ROC (125-Day): -0.7

Oversold conditions on RSII and MFI show a short-term bounce.

Improvement in fundamentals is something long term investors look for and not to the short-term fluctuations.

Suzlon Energy Share Price Growth Catalysts

- Government Policies: The government is very encouraging for renewable energy with a target of 500 GW by 2030. That will be quite supportive for Suzlon.

- Global Partnerships: International collaborations for the state-of-the-art technology and funds.

- Green Hydrogen Projects: Looking into the production of green hydrogen to balance the portfolio of renewables.

- Debt Management: A debt-equity ratio of 0.06 reflects very good finance discipline to pursue further investment opportunities.

- Market development: The market potential in Africa, Southeast Asia, and Latin America still remains attractive enough and yet remains unexplored.

Suzlon Energy: One Page Company Information

- Established in the year: 1995

- Headquartered at: Pune, India

- Business operations: Main business is wind turbine, renewable energy, hybrid power

- International Operations: The company operates its business in more than 17 countries: USA, China, and Europe.

- Recent Success: Committed to successfully commission over 18.5 GW of wind energy capacity worldwide.

Why Invest in Suzlon Energy?

- Sustainability Leader: Playing a very strong play in the green energy space.

- High Gross Margin: Most important indicator of scalability and profitability, with high growth possibilities.

- Low Interest Coverage: Suitable signal reflects that business is not dependent upon debt servicing.

- Strategic Focus: Is diversifying through solar and hybrid solutions for medium to long-run growth.

Frequently Asked Questions about Suzlon Energy

Q1: Is Suzlon Energy a long-term investment play?

Absolutely. Suzlon plays to the sector’s strength-that is sustainable energy, whose global goals cannot be ignored-it is a classic long-term proposition.

Q2: Why such a high P/E for Suzlon Energy?

It just means that investors believe that Suzlon’s future earnings would rise because of expansion into new markets and technologies.

Q3. What are Suzlon’s risks?

It is vulnerable to:

- Market Competition: Global renewable energy majors.

- Policy Risks: Any change in the subsidy or incentive schemes of the renewables.

- Operational Risks: Delay in project implementation and cost overrun.

Q4. Will Suzlon Energy Share Price reach ₹360 by 2030?

If Suzlon maintains its growth rate, profitability, and markets, it will reach ₹360 comfortably by 2030.

Conclusion: Green Future for Investors

Suzlon Energy is on the verge of becoming a market leader in the renewable energy sector. Suzlon Energy Share Price projection from ₹90 in 2025 to ₹360 in 2030 makes it a high-growth stock. Being an organization with robust financial stability and embracing innovative ideas along with the increasing demand for clean energy all around the world, Suzlon is a very good investment proposition for growth mind-set individuals looking at a long-term sustainable position.