Tata Motors Share Price Target From 2025 to 2030: One of the names doing the rounds in the automobile world based on innovation, technological advancement, and a very big portfolio of vehicles is Tata Motors Limited. It so happens to be India’s largest automobile manufacturer with huge presence in the commercial and passenger vehicle segments. The article tries to predict the share prices of the company from 2025 to 2030 based on financial health, operational strategies, and the health of the industry.

Company Overview

Tata Motors Limited is the flagship company of Tata Group with a legacy of more than 150 years for this global entity. From 1945, Tata Motors is one of the leading automobile manufacturers that make automobiles for both passenger and commercial segments besides electric vehicles. The company operates across geographies and further value-added its subsidiaries in the form of Jaguar Land Rover (JLR).

Key Features:

- Headquarter: Mumbai, India.

- Market Capitalization: ₹2.78 Lakh Crores

- P/E Ratio: 6.62

- Dividend Yield: 0.40%

- 52-Week High: ₹1,179.00

- 52-Week Low: ₹717.70

Tata Motors is a company that has really been taking sustainability seriously through electric vehicles and carbon footprint cuts. The electric arm is the market leader in India, Tata Passenger Electric Mobility.

Current Financial Status For Tata Motors Share Price

- Share Opening Price: ₹769.00

- Day’s High: ₹773.55

- Day’s Low: ₹754.40

- Current Price: ₹755.40

- Market Capitalization: ₹2.78 Lakh Crores

- EPS: Not disclosed; however, its P/E ratio is quite high at 6.62.

- Dividend Yield: 0.40%

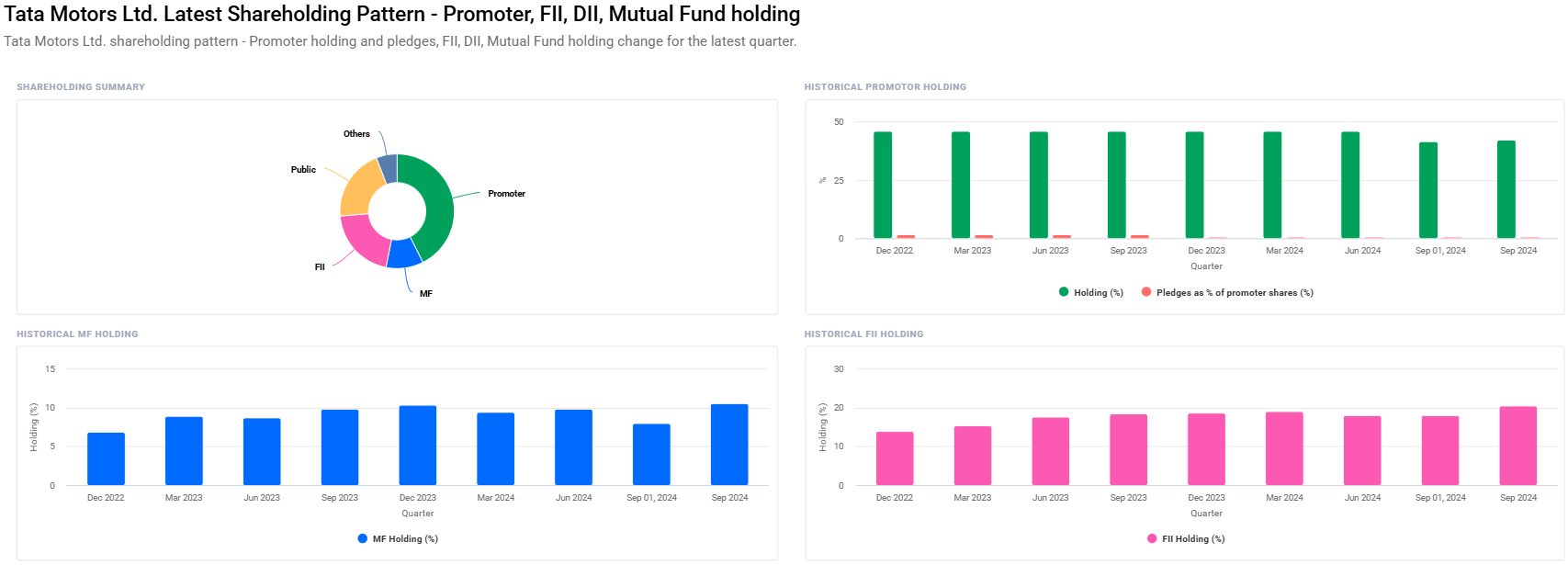

Shareholding Pattern For Tata Motors Share Price

- Promoters: 42.58% as against last year’s 46.36%.

- FIIs: 20.55% as against previous of 18.18%

- Retail and Others: 20.50%

- Mutual Funds: 10.58% as compared to previous year’s 9.83%

- Other Domestic Institutions: 5.79%

There have been declines in promoters’ shareholdings, yet FIIs as well as mutual funds are ramping up in a major manner. So it can be surmised that Tata Motors has become more confident to grow long term.

Tata Motors Share Price Target (2025-2030)

This would allow the company to multiply manifold in the following six years because of its domination in the electric vehicle market besides having financial muscle for expansion in international markets also. On account of the same growth drivers, share price targets of the company would be as follows:-

| YEAR | SHARE PRICE TARGET |

| 2025 | ₹1200 |

| 2026 | ₹1700 |

| 2027 | ₹2200 |

| 2028 | ₹2700 |

| 2029 | ₹3200 |

| 2030 | ₹3700 |

Growth Drivers of Tata Motors Share Price

1. Electric Vehicle Market Growth

The Tata Motors Group dominated Indian electric vehicle through the variants of Nexon EV and Tigor EV. For expanding its customer reach, the company is looking for mass-market as well as premium electric vehicles.

2. Jaguar Land Rover (JLR) posted strong performance

It is increasing revenue streams through its luxury auto business, JLR, placed perfectly in international markets and at a phase that continues to get ready for electrisation hence adding more layers to improve Tata’s overall performance.

3. Market Leader

Tata Motors is one of the largest players in the commercial vehicle space and market leader in the Indian passenger space. Increasing demand in the passenger space, coupled with infrastructure, will keep driving growth of the company from domestic markets.

4. Focus on Sustainability

Company sustainability and innovation focus has had a few carbon reduction initiatives in store. Green mobility by Tata Motors will, therefore, attract an eco-friendly investor base.

5. Institutional Appetite on the Rise

FIIs and mutual fund shareholding are increasing with institutional comfort high for Tata Motors growth cycle.

6. Strategic alliances and investments

Partnership joint ventures with the leaders in the world’s globe in terms of EV technology and high investments in R and D spends, Tata Motors will build and strengthen its businesses for the years ahead.

2025: Tata Motors Share Price Target ₹1,200

By 2025, the Tata Motors stock will be valued at ₹1,200. Heavy demands are coming in terms of electric vehicles and better output plus overall outstanding performances from the home country that will contribute most.

2026: Tata Motors Share Price Target ₹1,700

The stock prices, by 2026, will be at ₹1,700. This will take place with an increase in Tata Motors’ EV portfolio and sales by JLR continuously on the international markets.

2027: Tata Motors Share Price Target ₹2,200

The share price of Tata Motors is going to be ₹2,200 in 2027. The growth drivers are going to be leadership in EVs as well as persistent demand for the commercial vehicles.

2028: Tata Motors Share Price Target ₹2,700

In 2028, Tata Motors’ share price will touch ₹2,700. Growth in the usage of EVs in India along with strategic international expansion of Tata Motors will help the company in that direction.

2029: Tata Motors Share Price Target ₹3,200

The share price of the company will be ₹3,200 in 2029. This will happen due to the better operational efficiency and technology growth of EVs.

2030: Tata Motors Share Price Target ₹3,700

Expected Share Price of Tata Motors by the Year 2030: ₹3,700 Even after dominating a significant market space in the Global EV Market and increasing sales in the whole world and conducting more R&D works will finally count for this increase.

FAQs For Tata Motors Share Price

1. Tata Motors: is it a good long-term investment?

Yes, since it is the market leader in the EV space, and financially robust and is present in most countries.

2. What led to promoter holding in Tata Motors to decline?

The promoter holding came down to 46.36% from 42.58% considering equity dilution or strategic divestment may have happened at a point of time. Institutional holding is however witnessing an upswing, and it is silver there.

3. What do increased FIIs in Tata Motors reflect?

An increase in FII represents that global players who have faith in the Tata Motors growth story, especially its EV and luxury car business lines, are gaining confidence.

4. What are the risks involved in investing in Tata Motors?

Major risk factors: There is an economic slowdown that impacts the demand on the automobile sector; increasing competition for the electric vehicles segment; geopolitical events going on in various parts of the world and its impact on JLR sales.

5. What has Tata Motors made competitive in its EV line up in India?

This is why Tata Motors commands such a space in Indian EV, considering it offers an entire spectrum of EVs with attractive pricing and adequate dispersion of charging infrastructure.

6. Which JLR segment adds most to the Tata Motors’ top line?

In the earlier quarters, mainly on account of the luxury and high-margin variants of JLR, the Tata group has immensely benefited from JLR’s top lines. Planning for electric will further bolster Tata’s numbers in the short term.

7. What is the dividend yield of Tata Motors?

The dividend yield of Tata Motors stands at 0.40%, hence indicating that Tata Motors pays its shareholders.

Tata Motors is well placed to gain from the changed automobile industry dynamics. It will be electric vehicles and sustainability. Its Tata Motors Share Price target from 2025 to 2030 will be constant, thus a good play for long-term investors. Its domestic market leadership and an expanding international presence set Tata Motors in an excellent position to continue the trend in the automotive sector.