Tata Teleservices Share Price Target From 2025 to 2030: One of the most significant constituents of Tata Group, Tata Teleservices (Maharashtra) Ltd, boasts a proud leadership position among all the telcos of the country. An unfavorable scenario in the competitive telecom market environment did not dampen the bright prospects that such a forward-looking vision had within this company either. Here are the Share Price Targets that could be seen between 2025 and 2030 in its technical as well as a financial analysis and the frequently asked questions related to it.

Critical Technical, Market Information For Tata Teleservices Share Price

- Open: 74.70 INR

- High: 74.70 INR

- Low: 72.50 INR

- Market Cap: ₹14,601 Crores

- 52-Week High: 111.40 INR

- 52-Week Low: 65.05 INR

- Debt to Equity Ratio: -1.04

- EPS (TTM): -6.54

- P/E Ratio (TTM): Not Applicable

- Dividend Yield: 0.00%

- Promoter Holdings: 74.36%

Fundamental and Technical Analysis For Tata Teleservices Share Price

Fundamentals

- ROE: 6.68%

- P/B Ratio: 0.00

- Book Value: -97.26 INR

- Industry P/E: 113.27

Intraday Technical Analysis For Tata Teleservices Share Price

- Momentum Score: 38.7 (Neutral)

- MACD (12, 26, 9): -0.7 (Bearish Indicator)

- ADX: 17.0 (Weak Trend)

- RSI (14): 49.6 (Neutral Zone)

- MFI: 53.8 (Neutral Zone)

- ATR: 3.7

- Day ROC (125): -21.2%

Tata Teleservices Share Price Target for the years 2025-2030

| YEAR | TARGET PRICE (₹) |

| 2025 | ₹800 |

| 2026 | ₹1350 |

| 2027 | ₹1900 |

| 2028 | ₹2450 |

| 2029 | ₹3000 |

| 2030 | ₹3600 |

Company Summary

Tata Teleservices (Maharashtra) Ltd. provides telecommunication and broadband services in the form of wireline, wireless, and enterprise solutions. Being a part of much bigger Tata Group corp., the brand embodies reliability and ingenuity all over India. Despite the trend of the last couple of years depicting poor financial performances, Tata Teleservices is changing its gears to benefit from the spate of demands for digital communication services.

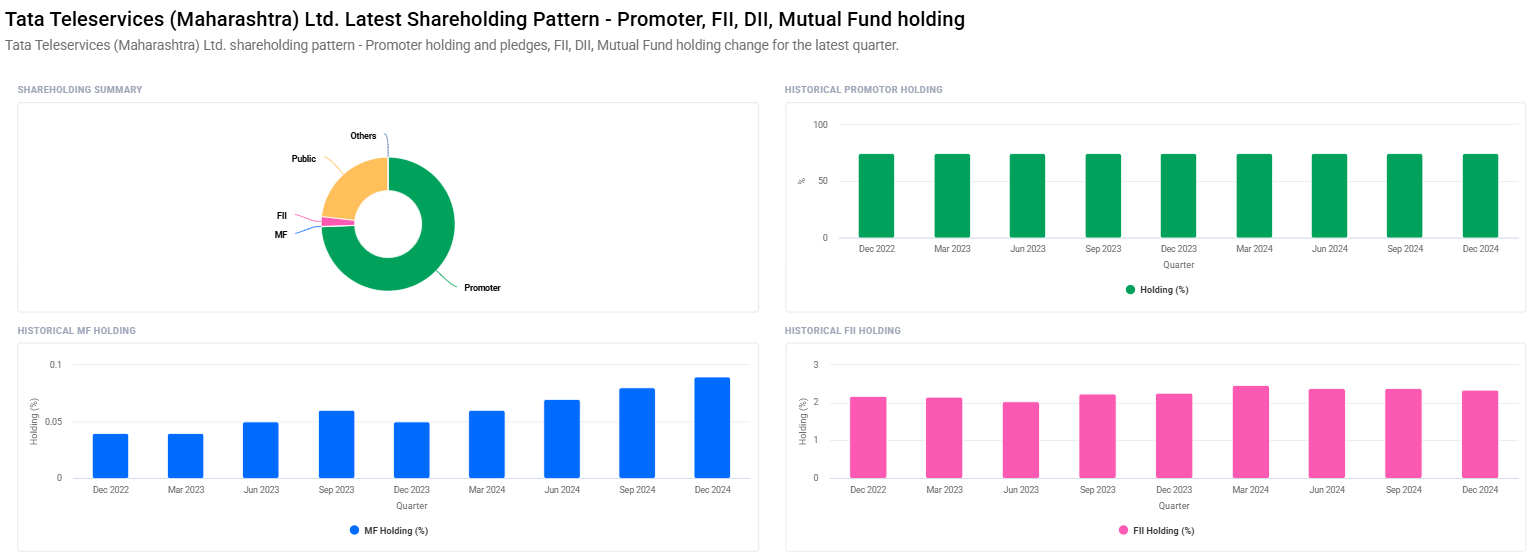

Promoter and Institutional Holdings For Tata Teleservices Share Price

- Promoters: 74.36%

- Retail and Others: 23.19%

- FIIs: 2.34%

- Mutual Funds: 0.09%

Activity last week For Tata Teleservices Share Price

- No change in holding by promoters of 74.36%.

- Fall in FII/FPI in holding from 2.39% to 2.34%.

- Rise in mutual fund holding from 0.08% to 0.09%.

Keys to Growth For Tata Teleservices Share Price

- 5G and Other Novel Technologies: 5G tech would be able to benefit faster for Tata Teleservices since it is putting out Internet of Things solutions.

- Digital Transformation: Its high demand in enterprise communication services permit it to grow the top line.

- Strategic Alliance: VALUE-ADDED SERVICES: such an alliance would provide value-added services with large technology houses.

- Cost Efficiency: Operational efficiency will increase its future financial performance.

Frequently Asked Questions (FAQs) For Tata Teleservices Share Price

1. Is Tata Teleservices a good long-term investment?

Tata Teleservices has faced a lot of issues recently, but its association with Tata Group and the scope for future expansion in digital communication make the stock worth watching the future for long-term investors.

2. Why is EPS negative?

It has witnessed losses in the recent quarters and, thus, has a negative EPS. But there are cost-cutting measures and strategic initiatives also available to create the same more profitable.

3. What would have made the stock price shoot to 3,150 INR till 2030?

From the stock some of the most important take-aways are implementation of 5G technology, expansion of its digital services lines, strategic alliance, and an increase in the demand for its enterprise solutions

4. What is the Dividend yield of Tata Teleservices?

Tata Teleservice does not specify the dividend yield as on the date.

5. How was the promoter’s holding trend in recent times?

Promoter holding has been constant at 74.36% and reflects that the promoters are positive about the company .

6. What are the risks involved in Tata Teleservices investment?

The risks involve market competition, regulatory changes, and financial instability because of losses made in the previous years.

7. Tata Teleservices future prospects based on technical analysis?

The stock is neutral at the moment, with RSI at 49.6 and the Momentum Score at 38.7, which does not indicate a significant upward or downward movement.

Tata Teleservices (Maharashtra) Ltd. has come to a decision point. The company, despite facing various financial issues in the past, has focused much on strategic change through digital transformation, cost optimisation, and technological innovation that promises much to the future. Share price target may reach INR 3,150 in 2030, which long-term investors would be in for a treat.