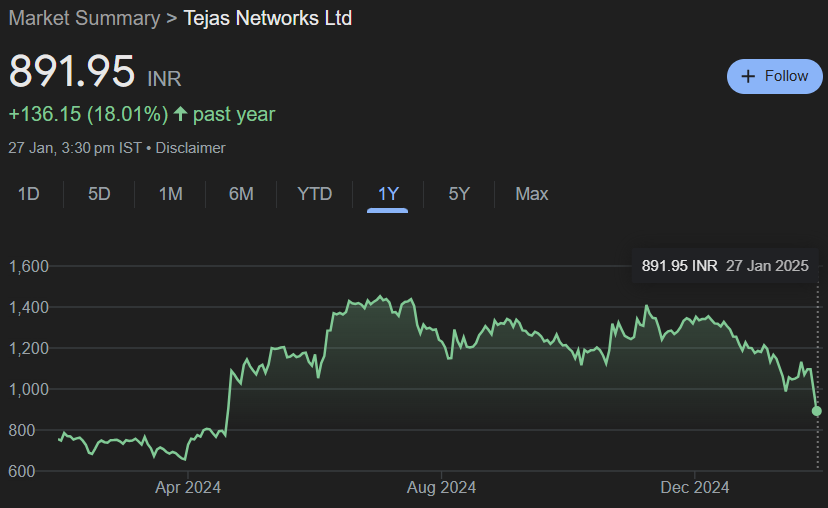

Tejas Networks Share Price Target From 2025 to 2030: Tejas Networks Ltd is the prime name across telecommunication and networking equipment companies in India. Growth is incredibly promising year to year. Tejas Networks Company has marked their presence in data, voice, as well as video communication networking product design, development, and manufacture. This research analyses the Share price target for the period from 2025 up to 2030 based on fundaments analysis and technical perspective considering market outlook also.

Company Background:

Tejas Networks Ltd. is an incorporated company in the year 2000. The specialist in telecommunications and broadband technology, it has a product portfolio of optical networking equipment, broadband access solutions, and related software. Domestic and international markets provide innovative yet cost-effective solutions to communication service providers, utilities, defense, and government organizations through Tejas networks.

Key Aspect of Tejas Networks:

- Headquarters : Bengaluru

- Type of Industry : Telecommunications Equipment

- Specialization: Optical and broadband access networking

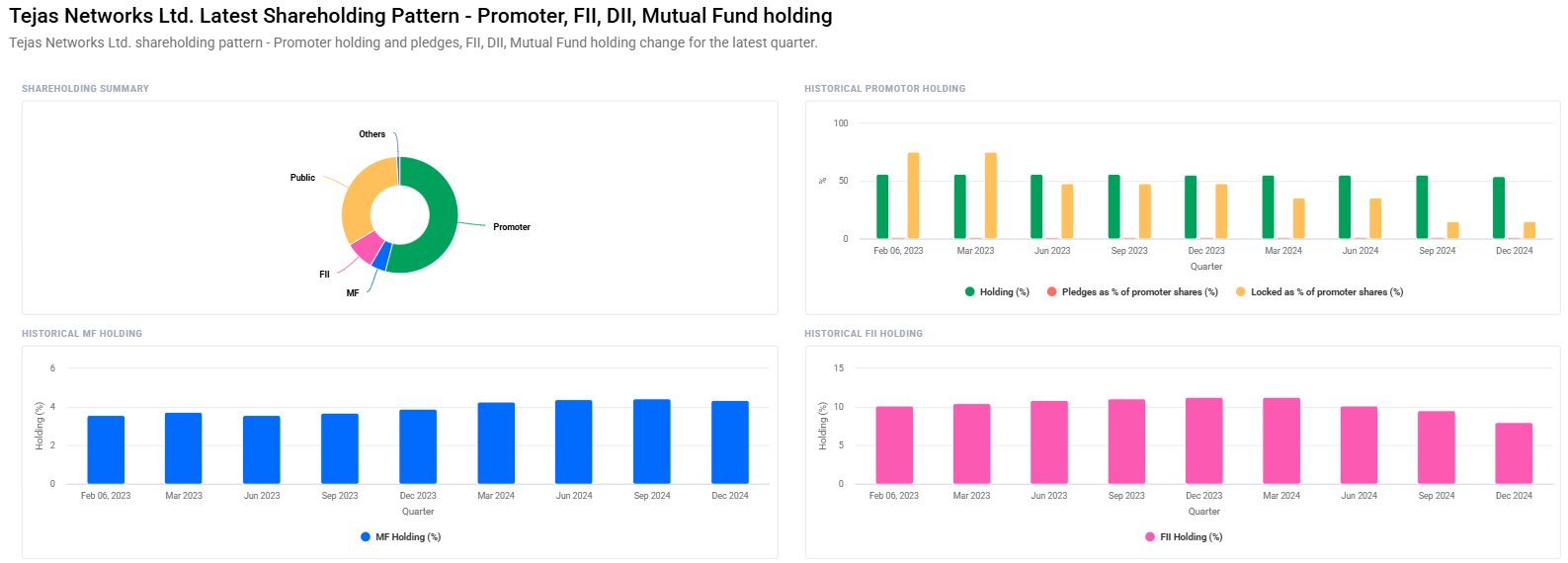

- Promoters Holding: 54.01% as of the end of last quarter.

- Market Cap: ₹15,728 crore

Tejas Networks recently restrengthened its research and development, which assures that what it has launched into the market very closely meets the communications market requirement to do business over the long term. This places the company in an even stronger pedestal to track a sustainable long-term growth trend.

Key Fundamentals For Tejas Networks Share Price

| Metric | Value |

| Open Price | ₹970.00 |

| High Price | ₹975.50 |

| Low Price | ₹861.20 |

| Market Cap | ₹15,728 crore |

| P/E Ratio (TTM) | 23.65 |

| P/B Ratio | 4.23 |

| ROE | 12.22% |

| Book Value | ₹211.74 |

| Debt-to-Equity Ratio | 0.78 |

| Dividend Yield | 0.00% |

Tejas Networks Share Price Target until 2025-2030

| YEAR | TARGET PRICE (₹) |

| 2025 | ₹1500 |

| 2026 | ₹2250 |

| 2027 | ₹3000 |

| 2028 | ₹3750 |

| 2029 | ₹4500 |

| 2030 | ₹5720 |

2025: Tejas Networks Share Price Target ₹1,500

For Tejas Networks, 2025 is going to be an expansion year because the innovative products that it is going to come up with would benefit the company, along with the growing demand for optical and broadband solutions. Coupled with this, the fundamentals of the company and government efforts to enhance the telecom sector might take the share price up to ₹1,500 by the end of the year.

2026: Tejas Networks Share Price Target ₹2,250

By the year 2026, Tejas Networks would have more global tie-ups and penetration of the 5G technology that would enhance their revenue base and see better profit margins with share prices targeting ₹2,250.

2027: Tejas Networks Share Price Target ₹3000

It would grow to a huge extent till 2027 due to the continuous policy of R&D by the firm as well as greater exposure in global markets. It will also be able to reach around stock price ₹3,000 considering its steep growth in profit margin along with a huge boost in the market.

2028: Tejas Networks Share Price Target ₹3,750

By 2028, Tejas Networks will be using a much more significant customer base and the development in networking technology. Other than its market penetration and strong operational efficiency, the share price target may go up to ₹3,750.

2029: Tejas Networks Share Price Target ₹4,500

Tejas Networks should look at good revenue headroom from the global telecom infrastructure upgradation, which is gaining more pace by 2029. That should reflect in the stock, and the target for this would be at ₹4,500.

2030: Tejas Networks Share Price Target ₹5,720

Tejas Networks can very easily become the market leader in the global space of telecommunications equipment by 2030. It is also also expected to drive its share price to ₹5,720 after continuing rising revenue and profit with a market preeminence.

Day Technical Analysis For Tejas Networks Share Price

Tejas Networks Ltd has arrived in the radar of the technical analyst from recent action. Let’s have a glimpse at some major points:

- Momentum Score: 27.9 (technical weakness)

- MACD: -59.5 (Bearish)

- RSI: 28.9 (Chance of oversold recovery).

- ROC(21): -25.4% (Show Bearish Trend).

- MFI: 32.4 (Approaching to Near Oversold.

- ADX: 31.9 (ADX in Mod-Strong trend.

Oversold RSI and MFI Short-term Bounce expected; But, negative MACD had already created warning signals long before.

Growth Drivers For Tejas Networks Share Price

- 5G Deployments: 5G Network Deployments would see further the High End Telecom equipments demanding more in their order

- Government Initiatives: The government of India through support policies and digital infrastructures would invest in the company, making it a better prospect for a future growing scenario.

- International Reach: All the expansion and partnership ventures would be undertaken by the company throughout the globe, and good revenue and market share contributions would be gathered from the company’s end.

- Newness Solution: Since R&D would be one of the major issues for the company, there would be enough grounds for such a firm to enjoy the upper edge as regards competitive networking solution offering.

Opportunities and Challenges/Risks For Tejas Networks Share Price

- Market Competition: The telecom equipment sector is quite competitive, and there are a number of global companies.

- Macroeconomic Factors: The general economic condition and currency fluctuation in the global economy can impact the profitability of the company.

- Technological Disruption: In such an environment where technological change is high, the organization needs to keep innovating to match the pace.

FAQs For Tejas Networks Share Price

1. Tejas Networks is good for long term investment?

Absolutely so, as it has strong fundamentals, a pipeline of products replete with high margin products, and strategic focus on growth markets.

2. What should the Tejas Networks Share Price be for the year 2025?

The Tejas Networks Share Price would be ₹ 1,500 by 2025 based on market trends and performance.

3. What is the advantage of 5G technology to Tejas Networks?

Tejas Networks is in demand of high-class equipment for the installation of 5G, therefore, the company would enjoy worldwide 5G deployment.

4. What is the major risk that is there to Tejas Networks?

Market competition, macroeconomic factors, and continuous technological innovation are some major risks.

5. Why the RSI of Tejas Networks is apparently to be over sold?

The stock is over sold and RSI was at 28.9, hence rebounding in the near term.

6. What is the dividend yield of the company?

The company does not pay any dividend, hence dividend yield stands at 0.00%.

With this, the company is very well-positioned and capitalized based on the growing demand for its telecommunication equipment in the country and abroad because of innovation and strategic growth focus. As such, the company will continue to produce a strong financial performance in the future. That is why the share price targets between 2025 and 2030 are quite high. However, in like fashion, as are any other type of investments, the risks presented above have to be considered in investing and carrying out proper research by the investor.