UPL Share Price Target From 2025 to 2030: The erstwhile firm United Phosphorus Limited now termed as UPL Ltd it is one amongst the biggest productions houses of the world producing agrochemical and industrial chemical which is useful to protect crop; the firm was operational more than 130 Countries since 1969 back days till the current date. Green solutions supporting bigger agricultural outcome as key concerns related to firm- food security based on sustainability agricultural technology-related concerns.

The company portfolio includes herbicides, insecticides, fungicides, seed treatments, and specialty chemicals. UPL is a first in the agrochemical industry and also possesses the reputation of innovation and environmental responsibility.

Financial Summary For UPL Share Price

- Market Cap: ₹47,652 Cr

- P/E Ratio (TTM): 1154.27

- P/B Ratio: 1.77

- Debt to Equity: 1.23

- ROE: -7.44%

- EPS (TTM): 0.55

- Dividend Yield: 0.16%

- Book Value: ₹358.80

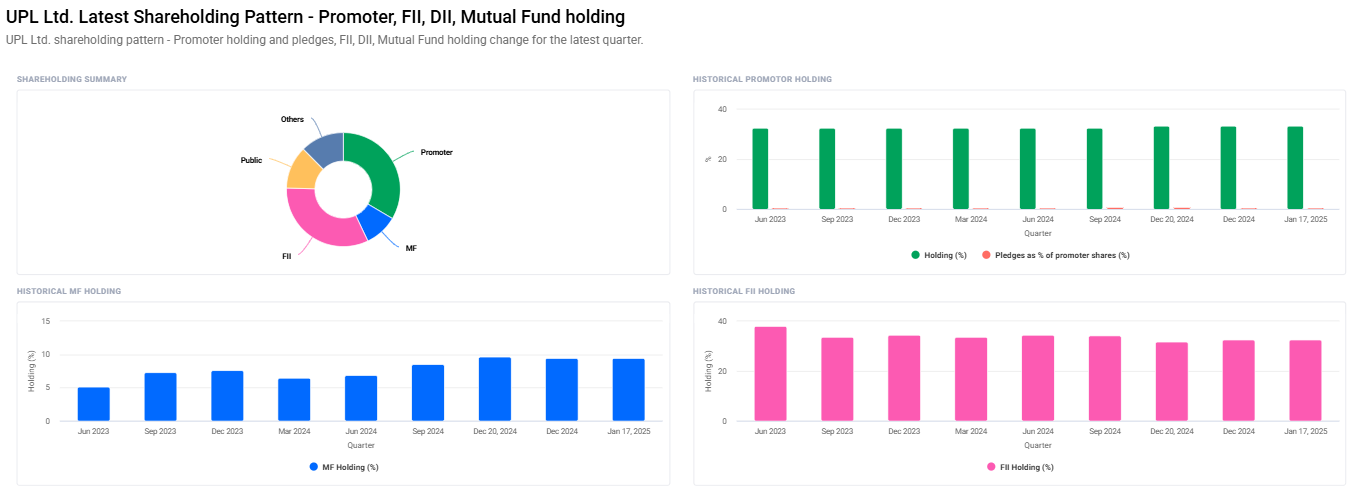

Key Shareholding Patterns For UPL Share Price

- Foreign Institutions: 35.46%

- Promoters: 33.50%

- Retail and Others: 12.14%

- Other Domestic Institutions: 9.46%

- Mutual Funds: 9.43%

Shareholding pattern had gone up in the number of promoters. It always maintained 32.52% of promoters and so had gone up up to 33.51%. Even the mutual fund investment had been enhanced from 8.51% to 9.43%. It distinctly depicts that all these rises will once again present a positive image in the mind of investors.

UPL Share Price Day Technical Analysis

- Momentum Score: 65.4 (Moderate Strong)

- MACD: 25.9 (Bullish Signal)

- ADX: 37.4

- RSI (14): 60.2 (Neutral to Over Bought)

- MFI: 77.3 Overbought

- ATR: 18.8

- ROC (21): 12.7

- ROC (125): 17.3

The above oscillators are on an up-swing with low power, warned since MFI is in the overbought region.

UPL Share Price Targets 2025 to 2030

2025: UPL Share Price Target ₹650

UPL will continue its business expansion through heavily relying on technological advancements that are going to make the company’s agriculture solutions much more efficient. The higher agrochemical requirement of developing countries should be a big leap for the revenues in terms.

2026: UPL Share Price Target ₹850

The share price could be rallied ahead of 2026 when probable strategic alliance and investments in sustainable agriculture practices would be offered to UPL. The company will move upward by improvement in operational efficiency and strong international presence.

2027: UPL Share Price Target ₹1050

With the present technologically and sustainability projects, UPL will touch the great landmarks by 2027. The institutional investors will have more and more interest in the company, and thereby the share price will break every barrier above ₹1000. 2028 : ₹1250

The fruits of investment in R&D would start yielding for the company, and thus UPL would continue to remain on top of markets. New customers as well as global markets would propel the run upwards.

2029: UPL Share Price Target ₹1450

Digital farming solutions and precision agriculture technologies would continue to be a growth thrust for UPL. Increased profitability and expansion in markets would attract record valuations to the stock.

2030: UPL Share Price Target ₹1650

Those factors would include market leadership, technology support, and sustainable growth revenues. Share of the company will touch up to ₹ 1650 till 2030.

Determine the UPL Share Price growth

- Sustainable agriculture: due to environmental social responsibility in the mind of the brand, investments will move to the company

- Market penetration: Due to success at the company level revenues will enhance for new markets penetration.

- Technology Upgrade: The R&D cost and the cost of the digital farming solution shall bring much-needed uptilt in operational efficiency.

- Strategic Alliance: An alliance with other foreign agriculture business shall support growth.

- Sound Regulatory Framework: The wholesome policies coming from the government for the sustainable agriculture sector shall uplift UPL.

Risk Factors For UPL Share Price

- Market Volatility: Such market volatility in terms of commodity price fluctuations would affect profitability.

- Regulatory Changes: Agricultural regulations may cause problems.

- Environmental Factors: Weather conditions, climate change may affect the demand for the product.

- Debt Levels: The debt-to-equity ratio of the company is 1.23 and has to be followed.

Frequently Asked Questions on UPL Share Price

1. What will be the UPL share price for 2025?

The share price target of UPL for the year 2025 would be ₹650.

2. Why is market capitalization of UPL important for the investor?

Market capitalization of UPL is at ₹47,652 Cr. UPL becomes a solid market player in agrochemicals. Investment here is safe.

3. What are the growth triggers of UPL?

Sustainable initiatives, technological advancement, market expansion, and strategic partnerships trigger the growth of UPL.

4. What will be the UPL share price for 2030?

In 2030, Share price of UPL will be approximately ₹1650.

5. What does RSI of UPL have to say about market behavior?

The RSI (14) of UPL at 60.2 suggests that market condition is neutral to slightly overbought, so caution should be there in terms of optimism.

6. How is UPL for long term investment?

UPL seems to be good long term investment in the stock markets since sound fundamentals and innovations have brought out market expansion.

7. What does UPL offer under sustainable agriculture?

UPL offers the following solutions under sustainable agriculture: green agrochemicals, precision farming technology, etc.

8. Why is MFI important for investors of UPL?

MFI of UPL came out to be 77.3. Security is in the overbought position and, hence, shall pull back in the short-term but would be seen to take off in the long-term.

9. How has the promoter holding changed?

The promoter holdings increased from 32.52% to 33.51%, which gives an impression that the promoters feel that the future for the company is bright.

10. What does MACD analysis reveal for UPL?

MACD value is quoted at 25.9; it is well above the signal line, revealing a bullish chart for the stocks.

UPL Ltd. will perform much better between 2025 to 2030 because it offers a solution, has the base presence of its market, and sustainability. Apart from risks, strategic initiative and technological advancements make it very convincing for long-term investors. Technical indicators along with market trends will be kept a track in forming an optimal investment strategy.