Vakrangee Share Price Target From 2025 to 2030: Vakrangee Ltd. is the largest technology-driven company in India, with last-mile retail services through its strong network of Vakrangee Kendras. The company offers an extensive range of services-from banking and insurance to e-commerce and logistics services-linking rural and urban India.

Company Facts

- Market Cap: ₹2,933 Cr

- P/E TTM: 451.33

- EPS TTM: ₹0.06

- Dividend Yield: 0.18%

- Debt to Equity Ratio: 0.05

- ROE: 1.83

- Promoter Holding: 41.67%

- 52-Week High: ₹38.20

- 52-Week Low: ₹18.45

Vakrangee Share Price Analysis

- Open: ₹27.24

- High: ₹28.70

- Low: ₹27.24

- MFI (Money Flow Index): 16.6-overbought strongly

- RSI (Relative Strength Index): 37.5-neutral zone

- MACD: Below its signal line, so bearish trend

- ATR (Average True Range): ₹2.19, so price activity is in medium

- ROC (Rate of change for 21 days): -21.86, so it’s on pressure from the bear side

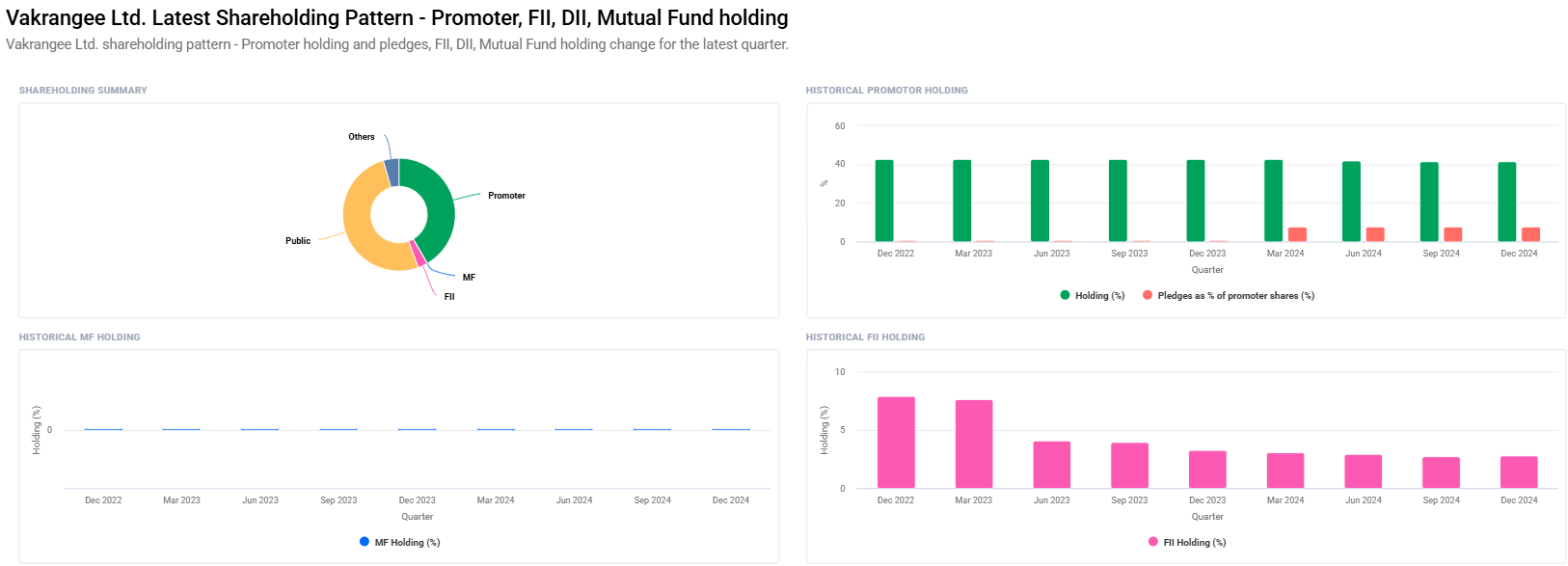

Shareholding For Vakrangee Share Price

- Retail & Others: 51.04%

- Promoters: 41.67% No change in promoter pledge at 7.75%

- Foreign Institutions: 2.82 % increased from 2.74 %

- Domestic Institutions: 4.47%

Vakrangee Share Price Target (2025 to 2030)

| YEAR | TARGET PRICE (₹) | ANALYSIS |

| 2025 | ₹40 | Consolidation growth with addition of network |

| 2026 | ₹60 | Follows digitalization route |

| 2027 | ₹80 | All kind of e-com and bank facilities improve |

| 2028 | ₹100 | Verticals |

| 2029 | ₹120 | Good position in the market, which lies at high-profit levels |

| 2030 | ₹140 | Growth from this technological revolution |

Technical Indicators and Market Sentiment For Vakrangee Share Price

- Momentum Score: 53.2 technically balanced one

- ADX: 23.9 non-trending one

- ROC (125 Days): 23.73 has long-term positivity

- MFI: Below 20. It has extremely powerful buy signal that is sure to rebound in near term.

Frequently Asked Questions For Vakrangee Share Price

1. Is Vakrangee a good long-term investment?

Vakrangee happens to be one of the great growth stocks on account of market position, increase in service offering, and support from promoters at every stage of business. Still, a P/E ratio calls for an eye at the profitability end.

2. What are some major factors that would impact the share price of Vakrangee?

The key factors affecting Vakrangee’s share price are technological upgradation, changes in regulation, and demand in the digital market.

3. Why is the P/E so high for the company?

This kind of P/E does reflect the market’s expectations of future growth. The investor would be looking for improvement in the earnings to support this kind of valuation.

4. What does the stability of promoter holding indicate?

The promoter holding stability is often a sign of confidence in the long-term prospects of the company.

5. How would an oversold MFI condition impact the share price prediction?

An oversold position is a signal that can provoke an emotional response. It will be an irresistible entry point for the investors.

The company, Vakrangee Ltd., is bound to witness expansion for ten successive years considering the technology and diversified services. All the technical indicators, however, are witnessing bearish trends at present. The long-term fundamentals, though, are quite strong.