Varun Beverages Share Price Target From 2025 to 2030: Varun Beverages Ltd., or VBL, is a company that manufactures, bottles, and distributes a wide array of carbonated soft drinks, non-carbonated beverages, and bottled water under the PepsiCo brand. Since it enjoys a strong market share and shares a dominant status through its powerful distribution networks, VBL has successfully cornered the largest share and dominated others among all other key players in the beverage industry of India.

Current Financial Position For Varun Beverages Share Price

- Open: 558.40 INR

- High: 561.10 INR

- Low: 532.70 INR

- Market Cap: 1.87 Lakh Crores

- P/E Ratio: 73.67

- Dividend Yield: 0.17%

- 52-Week High: 681.12 INR

- 52-Week Low: 516.95 INR

- Volume: 1,46,70,575

- Total Traded Value: 805 Crores

- Upper Circuit: 609.05 INR

- Lower Circuit: 498.35 INR

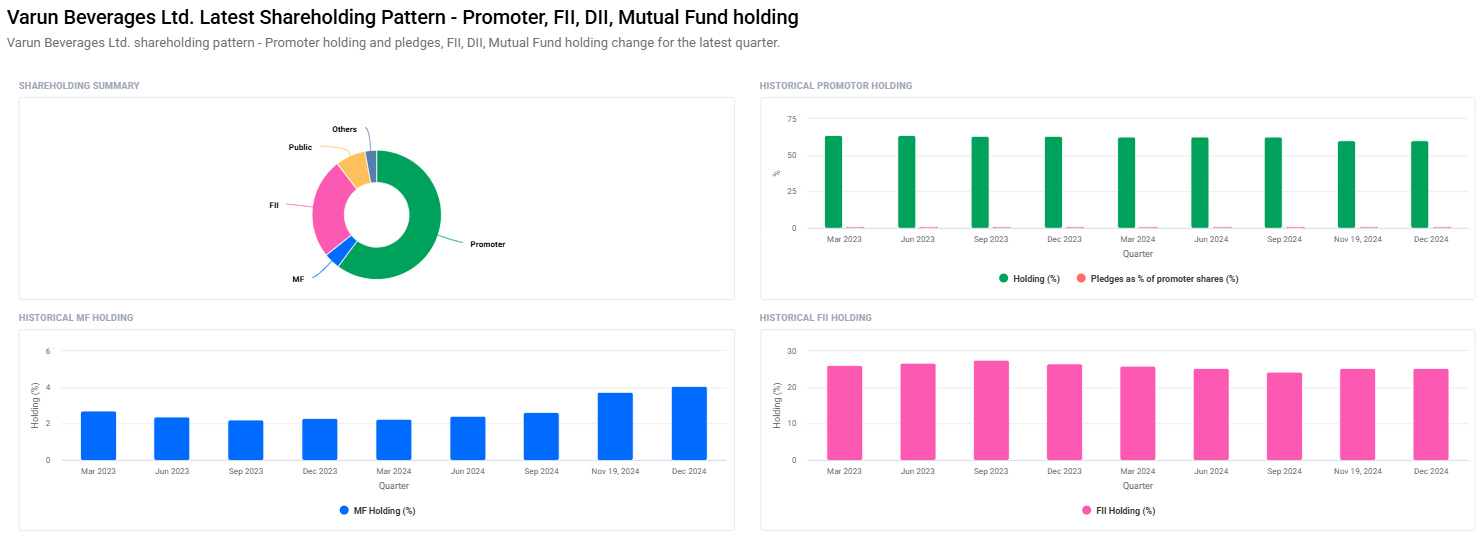

Institutional and Promoter Holding For Varun Beverages Share Price

- Promoters: 60.20% (Promoters’ pledge remained unchanged at 0.04% of holdings)

- Foreign Institutions: 25.26%

- Retail and Others: 7.52%

- Mutual Funds: 4.08%

- Other Domestic Institutions: 2.93%

Important Changes For Varun Beverages Share Price

- Promoters declined from 62.66% to 60.20%.

- FII/FPIs increased from 24.18% to 25.27%.

- Mutual Fund holdings increased to 2.63% then to 4.08%.

- Institutional investors held a total stake of 29.15% to 32.27%.

Technical Analysis Summary For Varun Beverages Share Price

- Day Momentum Score: 37.5 (Neutral)

- RSI (14): 43.1 (Neutral)

- MFI: 67.6 (Approaching Overbought)

- MACD: -8.2 (Bearish Indicator)

- ATR (Average True Range): 19.8 (Volatility Level)

- ROC (21): -7.2 (Recent Decline)

- ROC (125): -6.0 (Long-Term Decline)

Varun Beverages Share Price Target from 2025 to 2030

| YEAR | TARGET PRICE (₹) |

| 2025 | ₹700 |

| 2026 | ₹1050 |

| 2027 | ₹1400 |

| 2028 | ₹1750 |

| 2029 | ₹2100 |

| 2030 | ₹2450 |

2025: Varun Beverages Share Price Target 700 INR

With increased market penetration, along with further product innovation, Varun Beverages is expected to be well-positive regarding an uplift in revenue. Ready-to-drink beverages and premium bottled water are expected to grow.

2026: Varun Beverages Share Price 1050 INR

More operations in rural as well as urban markets will help VBL enhance its financial performance by 2026. More marketing campaigns and improvement in the product portfolio will further augment the profit in competitive advantages.

2027: Varun Beverages Share Price 1400 INR

The company will also have more international exports and collaborations also. Higher operational efficiency and clientele demand will maintain the stock price at an ascend.

2028: Varun Beverages Share Price 1750 INR

It may also lead to further growth with a stronger foothold in new beverage categories and diversification into healthier alternatives. Strategic acquisitions and collaborations may be observed.

2029: Varun Beverages Share Price 2100 INR

Varun Beverages can become the market leader in its segment by 2029 with advanced technology in manufacturing and distribution.

Varun Beverages Share Price by 2030: 2450 INR

Growth in both home and overseas markets with strategic product launch would propel the stock towards this goal.

Growth Drivers For Varun Beverages Share Price

- Health-focused beverages

- New Products and Innovative Product Line

- Presence in tier-2 and tier-3 cities.

- Growing Distribution Network.

- Automation in manufacturing and logistics.

- Technological Advancements.

- Higher consumption of non-carbonated beverages.

- Rising Demand.

Risks and Challenges For Varun Beverages Share Price

- Regulatory Risks: Changes in government regulations affecting the beverage industry.

- Environmental Concerns: Challenges related to plastic packaging and water usage.

- Market Competition: Increasing competition with other beverage houses.

- Economic Slows Down: Fluctuations of Spending on consumption.

FAQs For Varun Beverages Share Price

Q1: Is Varun Beverages Ltd. a good long-term investment?

Yes, Varun Beverages Ltd. has excellent growth prospects with its market leadership, strategic tie-up with PepsiCo, and strong distribution network. However, investors must note the market-related risks and volatilities.

Q2: What are the major drivers and deterrents for the Varun Beverages stock price?

A: Market demand for its products, regulatory changes, operational efficiency, product innovation, and competition.

Q3: What is the dividend yield for Varun Beverages Ltd.

A: The current dividend yield stands at 0.17%.

Q4: What is the expected share price target for 2025?

A: The expected share price target for 2025 is approximately 700 INR.

Q5: How do institutional investors view Varun Beverages?

A: Institutional investors increased holdings, and this appears to be their faith in the company’s growth path.

Q6: Technical Indicators that reveal the current market position of Varun Beverages

A: RSI-43.1, Momentum Score-37.5 classify the stock as neutral while MACD indicates a bearish trend.

Varun Beverages Ltd is one of the bright prospects that could be taken a view on the beverage sector, which has an effective portfolio and innovative products combined with strong operational strategies. Hence, in the long run, things look pretty good and could be seen as a worthwhile consideration by growth seekers from the FMCG sector.