Vedanta Share Price Target From 2025 to 2030: Vedanta Limited is one of the largest natural resources conglomerates of India and the leading mining and metals player. The company’s strong fundamentals, with a healthy dividend yield, have been drawing in investors. Here we are going to do an in-depth analysis of the share price target of Vedanta from 2025 to 2030. This would help you understand it well with its technical analysis, financials, and market sentiment.

Vedanta Limited Company Summary

Vedanta Limited is a natural resource exploration, production, and processing company which deals with oil, gas, zinc, copper, and aluminum. Its diversified portfolio has made it one of the biggest contributors to India’s economic growth.

Key Points For Vedanta Share Price

- Industry: Mining and Metals

- Headquarters: Mumbai, India

- Market Capitalization: ₹1.77 Lakh Crores

- P/E Ratio: 15.65

- Dividend Yield: 10.42%

- ROE (Return on Equity): 30.25%

- Debt-to-Equity Ratio: 2.13

With strong operation functions, Vedanta has been ahead in the market. Sustainability and its green initiatives add more value to it in the form of investor attraction.

Vedanta Share Price Historical Trend

- 52-Week High: ₹526.95

- 52-Week Low: ₹249.50

- Current Price: ₹452.60 (+79.50% in the last one year)

Vedanta has come out with great performance over the last year or so, and primarily it is for strong financials and high dividend payouts, thereby making it one of the most preferred income-driven investors’ bets.

Vedanta Share Price Target Prediction 2025 to 2030

| YEAR | TARGET SHARE PRICE |

| 2025 | ₹550 |

| 2026 | ₹850 |

| 2027 | ₹1150 |

| 2028 | ₹1450 |

| 2029 | ₹1750 |

| 2030 | ₹2050 |

2025: Vedanta Share Price Target ₹550

Vedanta will reach the middle stage of growth curve in 2025. Increased production capacity with optimized operations will push the share price to about ₹550 in 2025.

2026: Vedanta Share Price Target ₹850

The demand for metals like aluminum and zinc is going to rise in the year 2026 as going by the infrastructural and renewable energy projects that are happening across the globe. This shall propel the share price of Vedanta to ₹850.

2027: Vedanta Share Price Target ₹1,150

Diversification strategy and higher operational efficiencies by Vedanta would push it towards a massive growth till 2027. Apart from that, market share and profitability benefits will drive the share price to ₹1,150.

2028: Vedanta Share Price Target ₹1,450

As the company expands exploration and production businesses, with favourable commodity prices, the share price of the company is likely to reach ₹1,450 by 2028.

2029: Vedanta Share Price Target ₹1,750

By 2029, strong fundamentals and more focus on the renewable energy projects at Vedanta will command a higher valuation. The share price is likely to be there at ₹1,750.

2030: Vedanta Share Price Target ₹2,050

The leadership of the company in the natural resources sector is expected to remain intact until 2030. With steady revenue growth, good dividends, and strategic expansion, the share price target of the year 2030 stands at ₹2,050.

Vedanta Share Price Technical Analysis

- Momentum Score: 53.4

- MACD (12, 26, 9): -4.8, is bearish; the MACD line has declined below its middle line

- ADX: 18.7: the trend is relatively weak

- RSI (14): 49.0. Neutrality range: an RSI reading of below 30 is over sold while an RSI reading above 70 is over bought

- ROC (21): -4.6, minor fall.

- MFI: 49.9: a middle score

The technicals are neutral, but long-term fundamentals suggest a bullish position.

Fundamental Growth Drivers of Vedanta Share Price

1. High Dividend Yield: The dividend yield of the company is 10.42% and is a good bet for income-oriented investors. It’s a continuous payout, hence the cash flows and profitability by the company are quite strong.

2. High ROE: It displays how efficiently it raises returns for the shareholders, considering a very high ROE of 30.25%.

3. Diversified Products: The diversified portfolio products of the company in oil, gas, zinc, aluminum, and copper helps to avoid risk associated with the fluctuations in market trends.

4. Demand of Metal Across the World: Vedanta’s core products will continue to be demanded robustly due to growth day by day of infrastructures and clean energy projects worldwide.

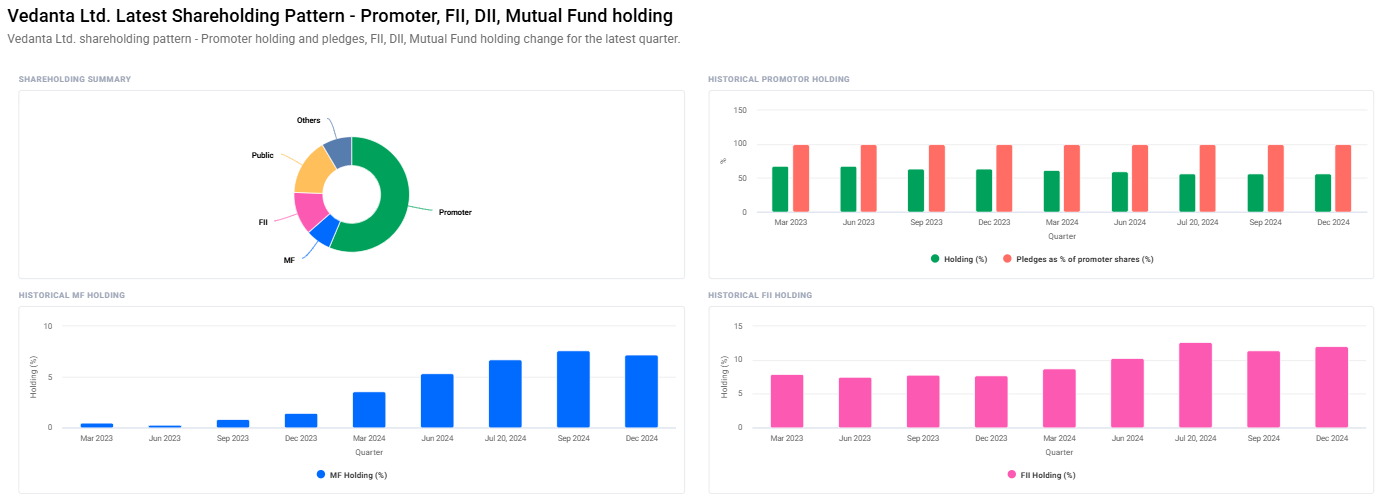

5. Promoter and Institutional Holding:

- Promoter Holding: 56.38% (Promoters pledged 99.99% of holding)

- Foreign Institutions (FII/FPI): Increased holding from 11.45% to 12.02%

- Mutual Funds: Decreased marginally from 7.62% to 7.16%

Risks to Watch For Vedanta Share Price

- Debt Level: At a debt-to-equity ratio of 2.13, Vedanta is at risk of a commodity price decline due to the high leverage.

- Regulatory Headwinds: Business impacted by environmental and legal regulations.

- Commodity Price Volatility: The performance of the company is correlated with the volatility of the metals and oil prices.

FAQs For Vedanta Share Price

Q1: Why invest in Vedanta?

Lots of long term investors can seek Vedanta for the simple reasons that it presents relatively high yield for dividend pay-outs and financial solidity as well as diversified portfolio.

Q2: What is Vedanta’s yield for dividends?

Its yield of 10.42% is pretty high.

Q3: What risk are involved with the investment of Vedanta?

Major debt level, regulatory issue as well as a volatile price for commodities form its main risk.

Q4: Is this one a good long-term bet for investment?

Yes. Being diversified with strong fundamentals and high dividend yields, Vedanta appears to be a good investible stock for long-term investors.

Q5: What is the target price of Vedanta for 2030?

The target price of Vedanta for 2030 is estimated at ₹2,050.

It has a good dividend yield, with sound fundamentals, and has diversified the portfolio well; therefore, it will benefit from the ever-growing demand for natural resources in the global economy, generating tremendous return to investors in the coming years. High debt and market volatility remain the risk; however, looking at its strategic move and the positioning of Vedanta in the market, one can be quite confident of the long-term growth prospects for Vedanta.