Waaree Renewable Share Price Target From 2025 to 2030: Waaree Renewable Technologies Ltd. is one of the most renowned renewable energy companies of India that will have an excellent run both in the short term and in the long run, with a robust base, innovative methods, and at a worldwide level, clean energy solutions. Talking about the present financial parameters, technical analysis, and the greater trends of the sector, share price projections from 2025 to 2030 will be written here.

Company Overview

Waaree Renewable Technologies Ltd is one of India’s biggest players in the renewable energy arena. Concentrated on solar energy solutions, it has under its belt an entire spectrum of broad products ranging from solar photovoltaic modules to inverters and even full turnkey solar EPC solutions. Ideated with innovation at Waaree, the firm puts itself at the very forefront of being one of the key players for India’s renewable energy goals.

- Market Cap: ₹9,914 Cr

- Debt-to-Equity Ratio: 0.10, Low Leverage

- ROE: 62.05%, High Profitability

- Dividend Yield: 0.11%, A reasonable return to shareholders

Key Financials For Waaree Renewable Share Price

- Current Share Price Range: ₹877.05 – ₹1,140.00

- 52 Week High: ₹3,037.75

- 52 Week Low: ₹472.28

- EPS: ₹18.96

- Book Value: ₹30.56

- Price-to-Book (P/B) Ratio: 31.12

- Industry P/E: 49.91

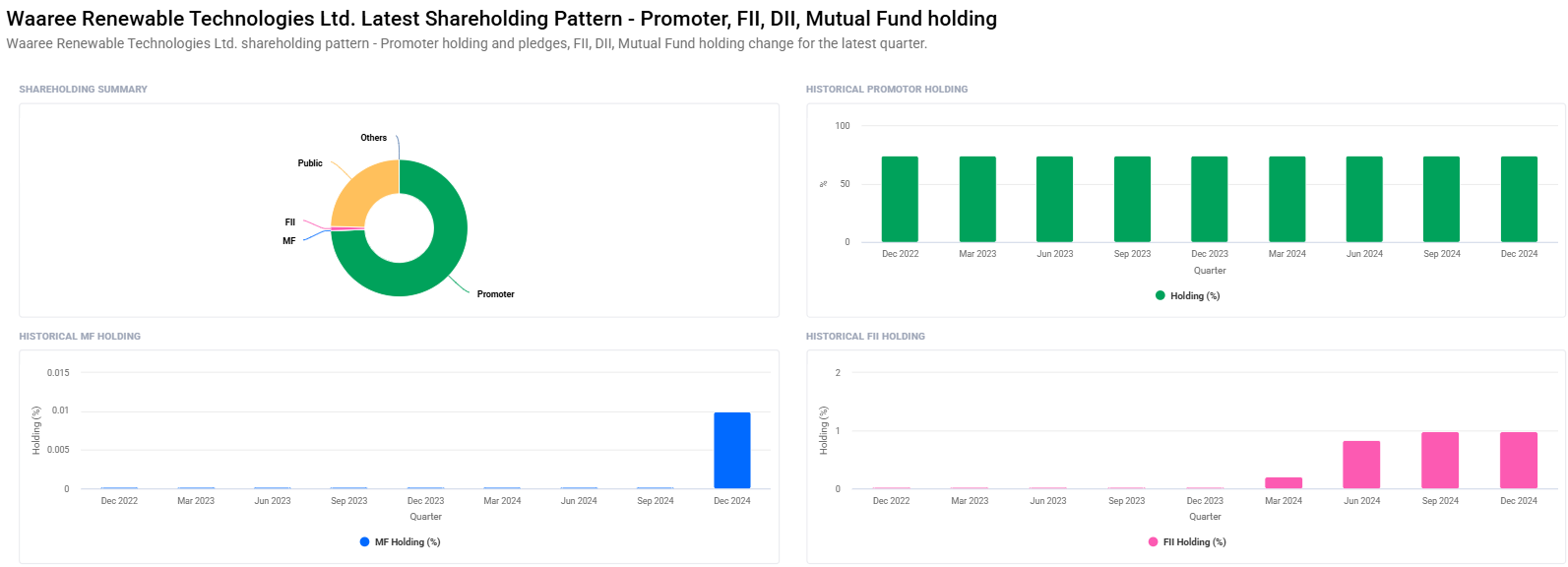

Shareholding Pattern For Waaree Renewable Share Price

- Promoters: 74.39%

- Retail & Others: 24.61%

- Foreign Institutions (FII/FPI): 0.99%

- Mutual Funds: 0.01%

Latest Holdings Changes For Waaree Renewable Share Price

- Promoters decreased their holding marginally by percentage from 74.44% to 74.39%.

- FIIs had increased the holding from 0.98% to 0.99%.

- This is a reflection of increased institutional investors. Hence, the interest is seen on the part of financial institutions too.

Technical Analysis For Waaree Renewable Share Price

- Momentum Score: 21.9 that indicates that the stock is technically week currently

- RSI: 36.5 at or near the region of oversold. The region below 30 is referred to as an oversold zone

- Average Directional Index (ADX): 30.1 It means that there is a moderately strong trend

- MACD :-78.7 bearish

- ROC(21-Day): -21.1 short term negativity in terms of momentum.

- Money Flow Index (MFI): 50.1, neutral zone

Short-term technical indicators give bearish momentum but long-term optimistic signals have been drawn as its strong fundamentals company combined with industrial prospect.

Waaree Renewable Share Price Targets 2025-2030

| YEAR | SHARE PRICE TARGET |

| 2025 | ₹3000 |

| 2026 | ₹5500 |

| 2027 | ₹8000 |

| 2028 | ₹10500 |

| 2029 | ₹13000 |

| 2030 | ₹15500 |

2025 : Waaree Renewable Share Price Target ₹3,000

As the global demand for renewable energy, along with favorable government policies are supporting it to increase the demand of solar energy solutions. Hence, this should increase its market share and capacity. Going forward, this should provide a pretty good boost to its share price.

2026: Waaree Renewable Share Price Target ₹5,500

Waaree’s profit margin would rise until 2026 due to economies of scale and the acquisition of new projects. Valuation would shoot up with increased investment from more institutional investors into green energy.

2027: Waaree Renewable Share Price Target ₹8,000

As Waaree performs stably with technological advancements, its share price would fly up to even newer heights. Use of renewable energy across the globe would put a rising growth curve for the company.

2028: Waaree Renewable Share Price Target ₹10,500

Waaree is likely to capture more market share with its phenomenal contribution towards India’s renewable energy targets. New collaborations with the government incentives are likely to increase revenue further.

2029: Waaree Renewable Share Price Target ₹13,000

The company is likely to see tremendous growth in revenue and profitability while expanding the global market. With mass acceptance for the innovative products and solutions by Waaree, the valuation is likely to shoot up.

2030: Waaree Renewable Share Price Target ₹15,500

Waaree Renewable Technologies would most probably become one of the leaders in the world for renewable energy by 2030. The strategic move of the company along with the dynamics of the industry will increase the share price.

The government has proposed that India is to witness exponential growth of the renewable energy sector by achieving 500 GW non-fossil fuel-based energy capacity by 2030. This will witness growth coupled with a huge play of solar energy, giving huge opportunities for companies like Waaree.

The major drivers for the industry are:

- Environmental consciousness is increasing.

- Policies being followed by the government along with available subsidies.

- More corporations will adopt renewable energy solutions.

- Lower-cost technological innovation in the solar energy-related system manufacturing.

Waaree Renewable Share Price Advantages

- Strong Brand Presence: The brand is Waaree that enjoys an excellent reach in the Indian solar energy market.

- Superior Products: This company makes some of the advanced products with only a few being high-end products.

- Stakeholder for Sustainability: The company thus caters to global environment-related goals by focusing on sustainability.

- Low Debt: It is having the debt-to-equity ratio as 0.10, that is, which says the firm is doing very good with its finance.

FAQs For Waaree Renewable Share Price

1. What does Waaree Renewable Technologies do?

Waaree Renewable Technologies is a solar energy solutions company in terms of modules photovoltaics, inverters, and also in EPC services.

2. Is it a good company for investment?

Yes, with robust fundamentals for Waaree, its low debt, and high ROE, this is a good opportunity to invest in the still-evolving renewable energy sector.

3. What are some inherent risks when one invests in Waaree?

The most inherent risks include cost escalations in raw materials, changes in policy, and stiff competition in the renewables domain.

4. Why is the momentum score so low for Waaree?

The low momentum score is indicating short term technical weakness in the name due to profit booking or some market corrections. Long run view is excellent.

5. What is the dividend policy of the company?

Waaree’s dividend yield is 0.11%. It is low return to its shareholders. Most of the profit of the company are usually re-invested in growth projects.

6. How does Waaree stand relative to the competition?

It is a very aggressive company with very high ROE, low debt, and a solidly constructed long-term market position.

Waaree Renewable Technologies Ltd is ready to ride the global boom in renewable energy. It is an enterprise being strongly armed with robust financials, a product portfolio of significant strength, and growing attention towards sustainability promising enormous returns to shareholders. Technical weakness during short periods would not augur well; if so, Waaree does seem highly promising in the long run. Waaree Renewable Share Price targets in 2025 might be around ₹3,000; in 2030, around ₹15,500.