Websol Energy Share Price Target From 2025 to 2030: Websol Energy Systems Ltd. is one of the leading companies for solar energy in India and has been manufacturing top-quality wafers, cells, and modules. It has gained a great reputation by gaining significant dominance in the renewable energy sector with increasing demand for solar power solutions all over the world. Websol Energy Systems Ltd. has, over the years, improved its market share in the solar industry, as the government is trying to make the country shift towards clean energy and sustainability.

It’s an excellent opportunity trend of increased demand for solar energy-capturing this massive shift to renewables. As investor interest grows along with Websol’s prospect, there’s a new stream of analyses taking place, making predictions over several years about where the stock stands. Let’s have a glance at detailed analysis in terms of share prices of Websol Energy, forecasted between the years 2025 to 2030 supported by technical outlook, market progress, and also future projection:.

Current Market Performance For Websol Energy Share Price

- Opening Price : ₹1,338.00

- Highest Price : ₹1,355.00

- Lower Price : ₹1,282.80

- Market Capitalisation : ₹5,869 Crores

- 52-week High : ₹1,865.00

- 52-Week Low : ₹320.20

- Last Close : ₹1,350.30

- Shares Traded : 2,12,918

- Shares Turnover : ₹27.31 Crores

- Upper Circut Limit : ₹1,417.80

- Lower Circuit Limit : ₹1,282.80

Websol Energy Share Price Performance and Market Information

Websol Energy has witnessed a sharp rise in the stock price, with a remarkable 264.28% increase in the last year. Despite the fluctuations in the market, the company’s stock performance has been resilient, especially in the volatile nature of the renewable energy sector.

It has witnessed a healthy upward trend in the recent past on account of the bankability of investor confidence in the long-term growth of the solar energy market. With the increasing government support and global trends in favor of clean energy solutions, Websol is placed well for growth in the next few years.

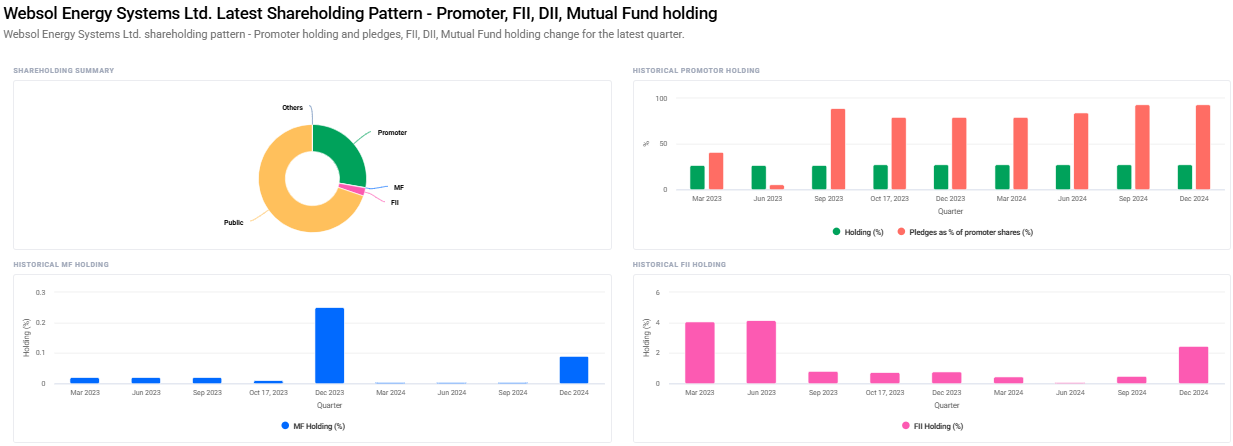

Ownership and Investor Profile For Websol Energy Share Price

The ownership pattern of Websol Energy Systems includes:

- Retail and Others: 69.75%

- Promoters: 27.71%

- Foreign Institutions (FII/FPI): 2.46%

- Mutual Funds: 0.09%

The institutional investor holding has increased. Foreign Institutions have upped its holding from 0.48% to 2.46%. This enhances the confidence of international investors in the company’s future prospects. With this, the FII/FPI investor count has also advanced from 11 to 26. This portrays more inclination towards larger institutional investment.

Financial Performances of Websol Energy Share Price

- P/E Ratio (TTM): -121.36. This defines a negative trend in earnings on a TTM basis.

- P/B Ratio: 30.94

- Industry P/E: 78.62

- Debt to Equity: 0.85

- ROE: 28.67%

- EPS (TTM): -11.14

- Dividend Yield: 0.00%

- Book Value: ₹43.69

- Face Value: ₹10

Despite its current losses that are showing the negative P/E and EPS figures, what can be valued about Websol is the company’s debt-to-equity ratio of 0.85; this points to the balance aspect of utilizing debts. Further, the company holds an ROE of 28.67% that explains how the business would be capable enough to yield the returns on investment for shareholders that is, to a considerable extent, is quite positive from long-term perspectives.

Technical Indicators and Market Feeling For Websol Energy Share Price

- Score Trend: 56.7 Neutral

- MACD (12, 26, 9): -66.0 BEARISH

- ADX: 23.0 Weak trend

- RSI (14): 35.2 The stock has approached the condition of being ‘oversold.’

- MACD Signal: -17.7 Bearish

- ROC (21): -18.5 Momentum falls

- MFI: 33.2 This stock is actually oversold.

- ATR(Average True Range): 91.1 Extreme volatility

Although the technical indicators are underlined as neutral to bearish in the short term, there is a possibility of rebounding as RSI and MFI are already oversold. The investors can be cautious in the near term but can look forward to potential upward movement as the market stabilizes.

Websol Energy Share Price Target Predictions (2025-2030)

We can project the share price of Websol Energy for the next coming years based on the trend in the market, growth prospect of the company, and the overall prospect of the renewable energy sector.

| YEAR | TARGET PRICE (₹) |

| 2025 | ₹1900 |

| 2026 | ₹3400 |

| 2027 | ₹4900 |

| 2028 | ₹6400 |

| 2029 | ₹7900 |

| 2030 | ₹9400 |

- 2025: Websol Energy Share Price Target ₹1,900

- 2026: Websol Energy Share Price Target ₹3,400

- 2027: Websol Energy Share Price Target ₹4,900

- 2028: Websol Energy Share Price Target ₹6,400

- 2029: Websol Energy Share Price Target ₹7,900

- 2030: Websol Energy Share Price Target ₹9,400

Based on the assumptions of Websol continuing its growing market share within the solar energy business, leverage positive governmental policies, and increasing its financials, this combined with renewable energies’ growth which Websol can scale operation would take this stock over a five-year timeframe.

Frequently Asked Questions (FAQ) For Websol Energy Share Price

1. What is the current market capitalization for Websol Energy?

From the last available data, Websol Energy has a market capitalization of ₹5,869 Crores, which proves its robust hold in the market.

2. Is Websol Energy a good investment for long run?

The company also has the promise of growth due to its opportunity in the future renewable energy fields. It looks like a more promising long term investment, as the world needs to shift eventually towards clean power. However one needs to see the current books and market and then decide any investment.

3. What has driven Websol Energy for growth?

Drivers for growth at Websol Energy include the rising demand for solar energy, support from the government towards renewable energy projects, and expanding product offerings in the space of solar energy.

4. Why is the P/E ratio negative for Websol Energy?

The low P/E ratio would reflect the unprofitability of the company in its current form. It could be due to high operational costs or strategic investments that the company is investing into. But when the company becomes mature and scales, profitability will increase more, making this P/E ratio stand out more.

5. What are the risks associated with an investment in Websol Energy?

Some of these risks may include the volatility of the stock price as it depends on market conditions, competition in the solar energy sector, and fluctuation in the government policies regarding renewable energy.

Conclusion: The Way Forward for Websol Energy

Websol Energy Share Price target from 2025 to 2030. The company would grow with the rising renewable energy market and scaling operations. The technical indicators do seem cautious in the short term, but the long-term view is promising.

With its existing market position, investor base, and growth opportunity in the Indian solar energy space, Websol Energy offers a huge possibility of becoming the most prominent actor in the new renewable energy face of India. Investors then have to weigh the prospective rewards against these risks associated with this high growth sector. The future of the company looks bright, but, as is always the case, due diligence and strategic planning are key considerations when investing in stocks, particularly in a dynamic sector like renewable energy.